Here's Why You Should Hold Surmodics (SRDX) Stock for Now

Surmodics, Inc. SRDX is well-poised for growth in the coming quarters, courtesy of its solid prospects in the thrombectomy business over the past few months. The optimism led by a solid first-quarter fiscal 2024 performance and its consistent efforts to boost research and development (R&D) are expected to contribute further. Yet, concerns regarding regulatory headwinds and reliance on third parties persist.

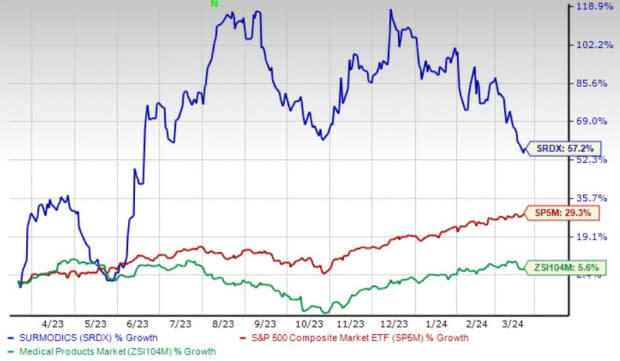

Over the past year, this Zacks Rank #3 (Hold) stock has gained 57.2% compared with the 5.6% rise of the industry and the S&P 500’s 29.3% growth.

The renowned medical device and in-vitro diagnostics technology provider has a market capitalization of $395.6 million. Surmodics projects 87.5% growth for fiscal 2025 and is expecting to maintain its strong performance. SRDX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average earnings surprise being 140.7%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Consistent Efforts to Boost R&D: Surmodics’ solid efforts to improve its R&D stature have been a key growth driver, which raises our optimism. The company’s whole product solutions pipeline and sirolimus-based below-the-knee drug-coated balloon program deserve mention. Surmodics has been making progress using its internally developed .014 balloon platform.

In the first quarter of fiscal 2024, Surmodics’ R&D expenses were 28.4% of total revenues. Medical Device R&D and other revenues increased 28.9% in the fiscal first quarter compared with the prior-year quarter, driven by increased volume of performance coating services.

Thrombectomy Prospects Bright: Surmodics’ aim to leverage its proprietary Pounce thrombectomy platform technology to develop products raises our optimism. Management, during its Investor Presentation in February, commented that it currently expects to initiate and complete limited market evaluations for the Pounce LP (Low Profile) thrombectomy system and transition to commercial launch as well as advance PROWL registry.

In January, Surmodics announced the successful early clinical use of the Pounce LP Thrombectomy System.

Strong Q1 Results: Surmodics registered a solid uptick in the overall top and bottom lines in the first quarter of fiscal 2024. The company recorded robust revenues from both segments and its primary sources.

Downsides

Regulatory Headwinds: Surmodics’ facilities and procedures are subject to periodic inspections by the FDA to determine compliance with the latter’s requirements. On account of non-compliance with applicable laws or regulations, the FDA could ban such medical devices. Any adverse regulatory action can potentially have a negative impact on Surmodics' business practices and operations.

Reliance on Third Parties: A principal element of Surmodics’ business strategy is to enter into licensing arrangements with medical devices and other companies that manufacture products incorporating its technologies. Revenues that the company derives from such arrangements depend upon its ability or its licensees’ ability to successfully develop, obtain regulatory approval for, manufacture (if applicable), market and sell products incorporating Surmodics’ technologies. Any failure to meet these requirements could have a material adverse effect on its business.

Estimate Trend

Surmodics is witnessing a positive estimate revision trend for fiscal 2024. In the past 90 days, the Zacks Consensus Estimate for its loss per share has narrowed from $1.00 to 88 cents.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2024 revenues is pegged at $28.8 million, suggesting a 5.9% improvement from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 76.9% compared with the industry’s 23% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 56.2% compared with the industry’s 15.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 55.3% compared with the industry’s 4.9% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report