Here's Why You Should Hold on to Xylem (XYL) Stock Right Now

Xylem Inc. XYL is benefiting from strong backlogs, owing to underlying demand despite weakness in the residential building solutions market, cost inflation and forex woes. Also, strong growth in the United States, Western Europe and emerging markets is driving Xylem’s top line.

What’s Aiding XYL?

Business Strength: Strength across the utilities and industrial water applications end markets augurs well for Xylem. The Measurement & Control Solutions segment is benefiting from improving supply chains and strong demand in the test and measurement market. Growth in the utilities and industrial end markets is boosting the Water Infrastructure segment’s performance. Strength in both the building solutions and industrial end markets/applications is a key catalyst to the Applied Water segment’s growth.

Expansion Efforts: The company’s expansion initiative is expected to drive growth. XYL acquired mission-critical water treatment solutions and services provider, Evoqua, in May 2023. Evoqua’s advanced water and wastewater treatment capabilities and exposure to key industrial markets complement Xylem’s portfolio of solutions across the water cycle. The acquisition bolsters Xylem’s position in water technologies, solutions and services, and strengthens its foothold in lucrative end markets. The transaction is expected to deliver run-rate cost synergies of $140 million (out of which $40 million is expected by 2023 end) within three years upon closing. It is also expected to strengthen the company’s balance sheet.

Rewards to Shareholders: The company’s measures to reward its shareholders through dividend payments and share buybacks are noteworthy. In the first nine months of 2023, Xylem paid dividends of $219 million, up 34.4% year over year. The company also bought back shares worth $10 million in the same period.

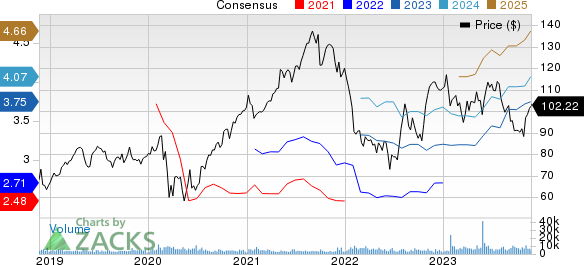

Xylem Inc. Price and Consensus

Xylem Inc. price-consensus-chart | Xylem Inc. Quote

In light of the above-mentioned positives, we believe, investors should retain XYL stock for now, as suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FLS delivered a trailing four-quarter average earnings surprise of 27.3%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2023 earnings has increased 3.1%. The stock has risen 20% in the past year.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 13.9%.

The consensus estimate for AIT’s fiscal 2024 earnings has increased 3.7% in the past 60 days. Shares of Applied Industrial have jumped 23.6% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 5%. The stock has risen 23.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report