Here's Why You Should Hold Zebra (ZBRA) in Your Portfolio Now

Zebra Technologies Corporation ZBRA has been benefiting from healthy demand for RFID (radio frequency identification) and software products. Improving supply chains and lower product lead times are expected to boost the company’s growth in the quarters ahead. Pricing actions and strong sales of RFID products are aiding the company’s Asset Intelligence and Tracking segment. Higher sales of services and software, and contributions from recent acquisitions bode well for the Enterprise Visibility & Mobility segment.

The company remains focused on cost-management actions. ZBRA announced expanded cost-reduction actions, including an incremental $65 million of annualized expense reductions, as it grapples with a slowdown in end markets. Along with the previous cost-reduction actions taken over the past year, the company expects to generate approximately $120 million in cost savings annually.

Zebra intends to strengthen and expand its businesses through buyouts. In this regard, the company's acquisition of Matrox Imaging (June 2022) enabled it to combine its fixed industrial scanning and machine vision portfolio with the latter’s expertise in the imaging market.

The buyout of antuit.ai (October 2021) complemented the planning and demand forecasting module for its retail software portfolio. Also, its Fetch Robotics buyout (August 2021) strengthened its capability to offer a comprehensive line of advanced robotic solutions to customers.

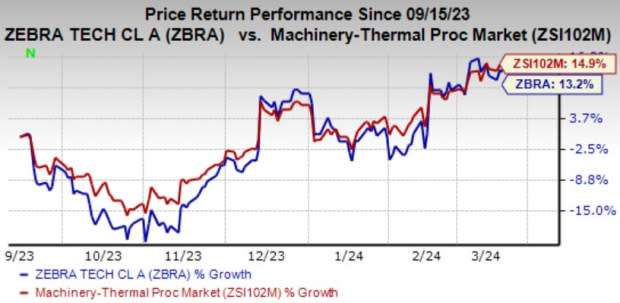

Image Source: Zacks Investment Research

In the past six months, this currently Zacks Rank #3 (Hold) company has gained 13.2% compared with the industry’s 14.9% growth.

However, the company has been bearing the brunt of distributor destocking, and weak demand for data capture and mobile computing solutions. Also, low demand for printing solutions has been affecting the performance of its Asset Intelligence & Tracking segment. Zebra has been witnessing low demand across retail, e-commerce and transportation logistics markets. These setbacks collectively impacted the company's fourth-quarter overall revenues, which totaled $1 billion, representing a decline of 32.9% year over year.

ZBRA’s weak liquidity position is also concerning. Exiting 2023, the company’s cash and cash equivalents totaled $137 million, less than the current portion of long-term debt of $173 million.

Stocks to Consider

Some better-ranked companies from the Zacks Industrial Products sector have been discussed below.

Atmus Filtration Technologies Inc. ATMU presently sports a Zacks Rank #1 (Strong Buy) and has a trailing four-quarter earnings surprise of 20.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ATMU’s 2024 earnings have increased 3.9% in the past 30 days. Shares of Atmus Filtration have risen 16.5% in the past six months.

Parker-Hannifin Corporation PH presently carries a Zacks Rank #2 (Buy). PH delivered a trailing four-quarter average earnings surprise of 14.4%. In the past 30 days, the Zacks Consensus Estimate for its 2024 earnings has increased 1.3%. Shares of the company have risen 37.6% in the past six months.

John Bean Technologies JBT presently has a Zacks Rank of 2. JBT delivered a trailing four-quarter average earnings surprise of 6.4%. In the past 30 days, the Zacks Consensus Estimate for John Bean Technologies’ 2024 earnings has increased 6%. The stock fell 3.9% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report