Here's Why You Should Invest in Adverum (ADVM) Stock Now

Adverum Biotechnologies ADVM is developing single-administration gene therapies for highly prevalent ocular diseases, leveraging the potential of its proprietary intravitreal (IVT) platform. Its lead gene therapy candidate, ixoberogene soroparvovec (Ixo-vec), is being developed as a one-time IVT injection for patients with neovascular or wet age-related macular degeneration (wet AMD), a leading cause of blindness in patients over 65 years of age. In 2023, it made great progress in the development of Ixo-vec.

Ixo-vec is designed to be administered in the physician’s office as a one-time injection, which can reduce the burden of frequent anti-vascular endothelial growth factor (VEGF) injections. The candidate enjoys Fast Track designation from the FDA to treat wet AMD. It is being evaluated in two clinical studies, OPTIC and LUNA.

Long-term data from the OPTIC extension study of patients with wet AMD was presented in November 2023. The data demonstrated that patients continue to experience substantial, long-term benefits from Ixo-vec through three years of follow-up, including maintenance of vision, durability of anatomical improvements and sustained reduction in anti-VEGF treatment burden. The data showed that around 50% of the patients remained entirely free of injections over the three-year period.

Initial safety and efficacy data from the LUNA phase II study are expected to be presented in February 2024. The first data presented from the LUNA study in September showed that both the 2E11 and 6E10 vg/eye doses of Ixo-vec produced aflibercept levels that are associated with significant clinical activity.

Adverum has some other IVT gene therapy pipeline candidates in its pipeline, which are being developed to treat blue cone monochromacy and geographic atrophy.

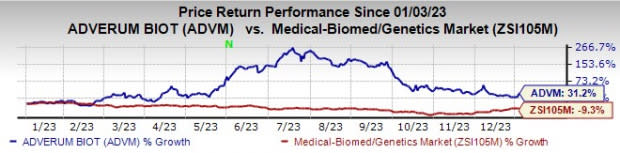

The stock has risen 31.2% in the past year against a decrease of 9.3% for the industry.

Image Source: Zacks Investment Research

Adverum currently carries a Zacks Rank #2 (Buy). In the past 60 days, the consensus estimate for Adverum Biotechnologies’ 2024 loss has narrowed from 94 cents per share to 82 cents per share.

Adverum Biotechnologies, Inc. Price and Consensus

Adverum Biotechnologies, Inc. price-consensus-chart | Adverum Biotechnologies, Inc. Quote

Other Stocks to Consider

Some other top-ranked drug/biotech companies worth considering are Novo Nordisk NVO, Aquestive Therapeutics AQST and Puma Biotechnology PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Novo Nordisk’s 2024 earnings per share have increased from $2.99 to $3.14 over the past 60 days. NVO’s stock has surged 51.3% in the past year.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, missed in one and matched estimates in one, delivering an earnings surprise of 0.58% on average.

In the past 60 days, the consensus estimate for Aquestive Therapeutics’ 2024 loss has narrowed from 56 cents per share to 34 cents per share. Aquestive Therapeutics’ stock has surged 132.3% in the past year.

Aquestive Therapeutics beat estimates in three of the trailing four quarters and missed the mark once, delivering an average earnings surprise of 70.58%.

In the past 60 days, the consensus estimate for Puma Biotechnology’s 2024 earnings has increased from 62 cents to 69 cents per share. PBYI’s stock has rallied 6.3% in the past year.

Puma Biotechnology beat estimates in three of the trailing four quarters and missed the mark once, delivering an average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Adverum Biotechnologies, Inc. (ADVM) : Free Stock Analysis Report

Aquestive Therapeutics, Inc. (AQST) : Free Stock Analysis Report