Here's Why You Should Invest in Alcon (ALC) Stock Now

Alcon ALC is gaining from strong consumables and equipment sales across Surgical and Vision Care franchises. Its upbeat 2023 guidance buoys optimism. However, escalated costs and a tough competitive space do not bode well for Alcon.

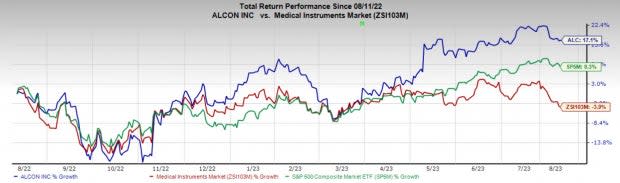

In the past year, this Zacks Rank #2 (Buy) stock has increased 17.1% compared with the 3.9% fall of the industry and a 8.3% rise of the S&P 500 composite.

The renowned pharmaceutical and medical device manufacturer has a market capitalization of $40.42 billion. Alcon projects a long-term estimated earnings growth rate of 14.9%. ALC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in one, delivering an average surprise of 8.85%.

Let’s delve deeper.

Upsides

Surgical Business Grows: In the first quarter, Total Surgical (consisting of implantables, consumables and equipment/other) recorded sales growth of 8% at CER. Within Implantables, excluding the impact from Korea, sales were up nearly 5% on a reported basis and approximately 9% on a constant-currency basis. Despite the increasing competitive activity, the company continued with its ATIOL market leadership for another quarter, with approximately half of the global market and two-thirds of the U.S. market. First-quarter sales were up 13% in consumables, driven by favorable market conditions and pricing. In equipment, sales were up 14% year over year on continued strong demand for cataract and Vit-Ret devices, particularly in international markets, as the company upgraded and expanded its installed base.

Vision Care Returns to Growth: Total Vision Care (comprising contact lenses and ocular health) reported sales grew 16% year over year at CER. The upside includes approximately 5 points of contribution from the ophthalmic pharmaceutical products the company acquired in 2022.

Image Source: Zacks Investment Research

Net sales of contact lenses increased 10% at CER. Sales were led by continued growth in silicone hydrogel contact lenses, including the Precision1 and Total product families and price increases.

Upbeat Guidance: The company expects its net sales projection in the range of $9.2-$9.4 billion, indicating growth of 6-8% at CER from 2022. The Zacks Consensus Estimate for ALC’s revenues is pegged at $9.24 billion.

Alcon raised its projection of core earnings per share in the range of $2.55-$2.65, suggesting growth of 20-24% at CER over 2022. The Zacks Consensus Estimate for ALC’s earnings is currently pegged at $2.59 per share

Downsides

Cost Pressure Remains: The cost of net sales in the quarter was up 6.5% year over year. The core operating margin was 14.2% in the quarter, contracting 14 bps year over year at CER. The company’s operating margin in the quarter was impacted by an unfavorable product mix from lower PCIOL sales in South Korea, higher R&D investment following the acquisition of Aerie and a negative 1.3 percentage point impact from currency.

Tough Competitive Landscape: Alcon faces intense competition in The ophthalmology industry and the surgical and vision care businesses. In the surgical business, Alcon faces a mixture of competitors, ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of specialized products.

Estimate Trend

Alcon has been witnessing a positive estimate revision trend for 2023. The Zacks Consensus Estimate for 2023 earnings per share has moved up from $2.60 to $2.64 in the past 39 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $9.35 billion. This suggests an 8.05% rise from the year-ago reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Penumbra, Inc. PEN, Integer Holdings Corporation ITGR and Intuitive Surgical, Inc. ISRG.

Penumbra, carrying a Zacks Rank of 1 (Strong Buy), reported second-quarter 2023 adjusted EPS of 43 cents, beating the Zacks Consensus Estimate by 53.6%. Revenues of $261.5 million outpaced the consensus mark by 3.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra has an 2024 estimate d growth rate of 57.9%. PEN’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 94.2%.

Integer Holdings reported second-quarter 2023 adjusted EPS of $1.14, beating the Zacks Consensus Estimate by 15.2%. Revenues of $400 million surpassed the Zacks Consensus Estimate by 8.9%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, beating the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

Intuitive Surgical has a long-term estimated growth rate of 14.5%. ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report