Here's Why You Should Invest in Align Technology (ALGN) Now

Align Technology, Inc. ALGN has been gaining from substantial Invisalign portfolio expansion. The company is focusing on expanding the workflow options of its leading iTero scanners. The raised 2023 outlook buoys optimism about the stock.

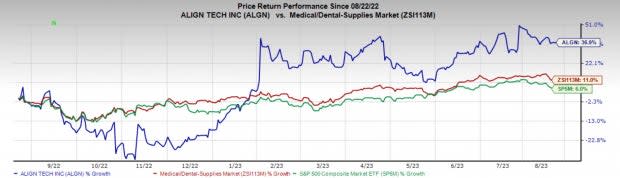

In the past year, this Zacks Rank #1 (Strong Buy) stock has gained 36.9% compared with a 6% rise in the industry and a 11% rise in the S&P 500 composite.

The renowned global medical device company has a market capitalization of $26.81 billion. The company’s expected long-term earnings growth of 17.5%, ahead of the industry’s 12.3% rise.

Let’s delve deeper.

Key Growth Drivers

Invisalign Portfolio Expansion: Align Technology’s Invisalign portfolio offers orthodontic treatment to straighten teeth without metal braces.

In the second quarter of 2023, the company successfully rolled out the Invisalign Comprehensive Three and Three product in APAC, which is now available in Hong Kong, Korea, Taiwan, and India. It also has plans to launch Invisalign Three and Three products in China in the third quarter of 2023.

The company launched Invisalign Comprehensive three and three products in most markets earlier. Instead of unlimited additional aligners within five years of the treatment end date, the latest configuration offers Invisalign comprehensive treatment with three other aligners included within three years of the treatment end date.

iTero in Focus: Align Technology has been focusing on expanding the workflow options of its leading iTero scanners. Of late, company revenues have been positively impacted by higher subscription revenues from many iTero scanners in the field. The company also had higher non-systems revenues reflecting increased scanner rentals, upgrades and certified pre-owned or CPO leasing programs.

Recently, the company talked about iTero-exocad Connector, which integrates iTero intraoral camera and NIRI images with exocad DentalCAD 3.1 software and allows dental professionals to visualize the internal and external structure of teeth. According to the company, the use of iTero scanners for Invisalign case submissions continues to grow and remains a positive catalyst for Invisalign utilization.

Upbeat Guidance: ALGN anticipates revenues in the range of $3.97 billion-$3.99 billion for the full year, implying a 12% improvement from 2022 at the midpoint. The Zacks Consensus Estimate for Align Technology’s 2023 revenues is pegged at $3.89 billion.

Image Source: Zacks Investment Research

The company expects a 2023 GAAP operating margin of slightly more than 17% and an adjusted operating margin of slightly higher than 21%.

For 2023, Align Technology expects investments in capital expenditures to be approximately $200 million. Capital expenditures are primarily related to building construction and improvements and additional manufacturing capacity to support Align Technology’s international expansion.

Estimate Trend

In the past 90 days, the Zacks Consensus Estimate for Align Technology’s 2023 earnings has moved 5.3% north to $8.75.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $3.98 billion, suggesting a 6.5% surge from the year-ago reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Elevance Health, Inc. ELV, Integer Holdings Corporation ITGR and Patterson Companies, Inc. PDCO.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Integer Holdings reported second-quarter 2023 adjusted EPS of $1.14, beating the Zacks Consensus Estimate by 15.2%. Revenues of $400 million surpassed the Zacks Consensus Estimate by 8.9%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Patterson Companies has an Earnings ESP of +5.66% and a Zacks Rank of 1. PDCO has an estimated long-term growth rate of 9.2%.

Patterson Companies’ earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 4.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report