Here's Why You Should Invest in Insulet (PODD) Stock for Now

Insulet Corporation PODD is gaining from the significant progress with respect to its development roadmap of the Omnipod 5 system. The international rollout of the device continues successfully. Meanwhile, inflationary pressures will likely sustain throughout the year, affecting the company’s gross margins and net income. Stiff competition also remains a concern for Insulet.

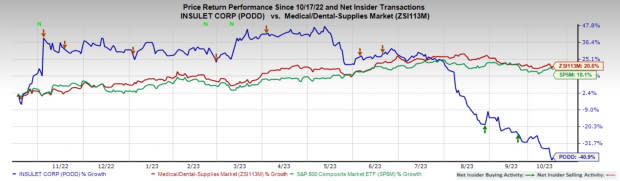

In the past year, this Zacks Rank #2 (Buy) stock has declined 40.9% compared with the 20.6% fall of the industry and a 18.1% rise of the S&P 500 composite.

The developer, manufacturer and distributor of insulin delivery systems has a market capitalization of $9.24 billion. Insulet projects a long-term estimated earnings growth rate of 35.7% compared with 13.8% of the industry.

Let’s delve deeper.

Upsides

Omnipod DASH’s Market Access Expansion Continues: Insulet has achieved several milestones with respect to expanding Omnipod’s market access.

In second-quarter 2023, Insulet registered continued strong adoption of Omnipod DASH in its international markets. In the United States, the company is registering recurring revenues from Omnipod DASH.

Omnipod 5, a New Focus: Insulet has been progressing with its development roadmap of the Omnipod Horizon (now Omnipod 5) automated insulin delivery (AID) system.

Per the second-quarter earnings update, Omnipod 5 continues to disrupt the diabetes technology market as the only FDA-approved, fully disposable, pod-based automated insulin delivery system. Omnipod 5 continues to be a driving force of the strong U.S. growth and, in the second quarter, represented almost 95% of U.S. new customer starts. Meanwhile, the company has completed the commercial launch of Omnipod 5 in the U.K. and Germany. Omnipod 5 continues to attract substantial new customer starts across all age groups.

Favorable Solvency but Leveraged Balance Sheet: At the end of the second quarter of 2023, Insulet reported short-term payable debt of $29 million against the corresponding cash and cash equivalents of $660 million. This indicates a sound financial position.

Image Source: Zacks Investment Research

Meanwhile, Insulet’s total debt-to-capital is 71.6%, representing a sequential decrease of 1.9%. However, times interest earned for the company is 5.7%, a massive increase from the first quarter’s 1.2%.

Downsides

Concerns Denting Profit Margin: Insulet is incurring higher costs associated with Omnipod 5 production. Added to this, higher production costs due to global inflation, supply chain disruptions and labor shortages continue to put pressure on margins.

During the second quarter, selling, general & administrative expenses rose 2.5%, while research and development expenses rose 29.3% year over year.

Tough Competitive Pressure: Insulet operates in a highly competitive environment dominated by firms ranging from large multinational corporations with significant resources to start-ups. Also, the competitive and regulatory conditions in the company's markets limit Insulet’s ability to switch to strategies like price increases and other drivers of cost increases.

The company’s Omnipod System primarily competes with Medtronic’s market-leading MiniMed, a division of Medtronic. MiniMed boasts a major part of the conventional insulin pump market share in the United States. Other suppliers in the United States include Tandem Diabetes Care, Inc.

Estimate Trend

The Zacks Consensus Estimate for Insulet’s 2023 earnings per share (EPS) has moved up from $1.45 to $1.65 in the past 90 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $1.62 billion. This suggests a 24.5% rise from the year-ago reported number.

Key Picks

Some other top-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health CAH and Align Technology ALGN, each carrying a Zacks Rank #2.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 25.5% against the industry’s 8.9% decline in the past year.

Cardinal Health stock has risen 21.3% in the past year. Earnings estimates for the company have increased from $6.65 to $6.66 for 2023 and have remained constant at $7.56 for 2024 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.03%. In the last reported quarter, it posted an earnings surprise of 4.73%.

Estimates for Align Technology’s 2023 earnings have moved up from $8.77 to $8.78 per share in the past 30 days. Shares of the company have increased 27% in the past year compared with the industry’s rise of 14.3%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report