Here's Why You Should Invest in Neogen (NEOG) Stock Now

Neogen Corporation NEOG is progressing well with the transition manufacturing arrangement for the flagship Petrifilm product line, emphasizing continued innovation to capitalize on the leading market position. Meanwhile, escalated operating costs are concerning.

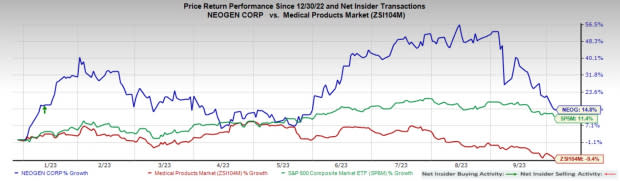

In the past year, the Zacks Rank #2 (Buy) stock has gained 14.8% compared with a 9.4% fall in the industry and a 11.4% increase of the S&P 500.

The renowned food and animal safety products provider has a market capitalization of $3.75 billion. The company’s fiscal fourth-quarter earnings surpassed the Zacks Consensus Estimate by 40%.

Let’s delve deeper.

Factors At Play

3M Acquisition: A Strategic Deal: During the fiscal fourth quarter, the performance of the 3M Food Safety division improved significantly, with core revenue growth of almost 8% on a pro forma basis. The growth was led by Petrifilm, which grew low double digits and included a reduction in backlog of past due orders.

The company has made good progress with its transition manufacturing arrangement for Petrifilm and believes they are on a path to sustainable higher production levels. Including the former 3M business, core growth for Neogen was mid-single digits on a pro forma basis.

Product Launches: Neogen, of late, has been focusing on product launches to strengthen its business on a global scale.

In August 2023, Neogen launched Igenity Enhanced Dairy, a new and progressive genomic data management tool. The same month, Neogen launched an extensive selection of new genetic tests through Paw Print Genetics and Canine HealthCheck solutions. These new tests can identify genetic sequences associated with potential diseases and other traits and can provide invaluable insights into a canine’s genetic composition.

In June 2023, Neogen launched My CatScan 2.0, a significantly upgraded and improved version of the test from a leader in cat genetic screening.

In May 2023, Neogen launched two new assays for detecting histamine, Reveal for Histamine and Reveal Q+ for Histamine.

Animal Safety Business Grows Well: Neogen’s Animal Safety segment continues to grow, led by sales of vet instruments and disposables and a new line of business at a large retail customer. Neogen grows solidly in cleaners, disinfectants and rodenticides within the biosecurity portfolio.

Image Source: Zacks Investment Research

Regarding the latest development, worldwide genomics revenue was up mid-single digits during the fiscal fourth quarter on a core basis, led by solid growth in international beef markets and companion animal testing.

Downsides

Mounting Operating Expenses: In the fiscal fourth quarter, sales and marketing expenses rose 100.6%, whereas administrative expenses rose 129%. R&D expenses were $7.1 million, up 84.1% year over year. Operating costs were up 112.4% from last year’s quarter.

Currency Headwinds: In the fourth quarter of fiscal 2023, Neogen’s international business was impacted by unfavorable currency movements of 1%. When the magnitude of the pandemic became evident, and as it began moving around the world, there was a move toward the safety of the U.S. dollar, negatively impacting local currencies in the company’s international locations, particularly those where the outbreaks were less controlled.

Estimate Trend

In the past 90 days, the Zacks Consensus Estimate for Neogen’s earnings for 2023 has moved 11.1% north to 60 cents.

The Zacks Consensus Estimate for 2023 revenues is pegged at $966 million, suggesting a 17.5% rise from the 2022 reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are DaVita Inc. DVA, Quanterix QTRX, Align Technology ALGN, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%.

DaVita has gained 23.5% against the industry’s 8.9% decline over the past year.

Estimates for Quanterix’s 2023 loss per share have remained constant at 97 cents in the past 30 days. Shares of the company have surged 141.5% in the past year compared with the industry’s fall of 5.6%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for Align Technology’s 2023 earnings have moved up from $8.77 to $8.78 per share in the past 30 days. Shares of the company have increased 27% in the past year compared with the industry’s rise of 14.3%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report