Here's Why You Should Invest in Pioneer (PXD) Stock Right Now

Pioneer Natural Resources Company PXD has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days.

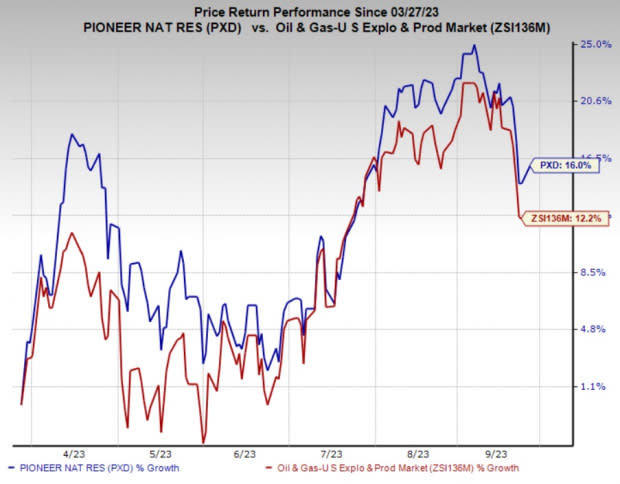

The stock, currently sporting a Zacks Rank #1 (Strong Buy), has gained 16% in the past six months compared with 12.2% growth of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

What’s Favoring the Stock?

The West Texas Intermediate crude oil price, currently surpassing $88 per barrel, presents a highly advantageous situation for oil exploration and production companies. Pioneer is in a strong position to capitalize on the favorable commodity price environment.

Pioneer maintains a robust foothold in the low-cost, oil-rich Midland Basin, which is a sub-region within the expansive Permian Basin. As an upstream energy company, Pioneer boasts an extensive inventory of high-quality wells that hold the potential to yield substantial returns for the company.

In 2023, the company plans to operate an average of 23 to 25 horizontal drilling rigs in the Midland Basin, with an average of three rigs operating in the southern Midland Basin region. This will result in a notable uptick in oil and gas production, bolstering the company’s revenues as it taps into additional hydrocarbon reserves.

Pioneer has consistently expanded its production over the years, driven by its significant reserves and ongoing exploration efforts. If global energy demand continues to rise, the company’s growth potential in terms of production and revenues could be substantial.

For 2023, Pioneer expects a total production of 697-717 thousand barrels of oil equivalent per day (MBoe/d), indicating an increase from the 649.8 MBoe/d reported in 2022. Coupled with the advantageous crude pricing environment, the company stands to potentially enhance its profitability.

PXD’s debt to capitalization has been persistently lower than the industry over the past few years, reflecting considerably lower debt exposure. This demonstrates the company's robust financial position on which it can rely to sail through volatile energy businesses.

Other Stocks to Consider

Investors interested in the energy sector might look at the following companies that also presently flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners, LP USAC is one of the largest independent natural gas compression service providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Helix Energy Solutions Group, Inc. HLX is an international offshore energy company that provides specialty services to the offshore energy industry, with a focus on their growing well intervention and robotics operations.

HLX has witnessed upward earnings estimate revisions for 2023 and 2024 over the past 60 days. The Zacks Consensus Estimate for Helix Energy’s 2023 and 2024 earnings per share is pegged at 48 cents and 87 cents, respectively.

Range Resources Corporation RRC is among the top 10 natural gas producers in the United States. In the prolific Appalachian Basin, the company has a strong focus on stacked-pay gas projects.

Range Resources has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for RRC’s 2023 and 2024 earnings per share is pegged at $2.10 and $2.94, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report