Here's Why Investors Should Avoid Landstar (LSTR) Stock Now

Landstar System LSTR is currently mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Let’s delve deeper.

Southward Earnings Estimate Revisions: The Zacks Consensus Estimate for fourth-quarter 2023 earnings has been revised 15% downward over the past 90 days. For 2023, the consensus mark for earnings has moved 3.3% south in the same time frame. The unfavorable estimate revisions indicate brokers’ lack of confidence in the stock.

Weak Zacks Rank and Style Score: Landstar currently carries a Zacks Rank #5 (Strong Sell). Moreover, the company’s current Momentum Style Score of C shows its short-term unattractiveness.

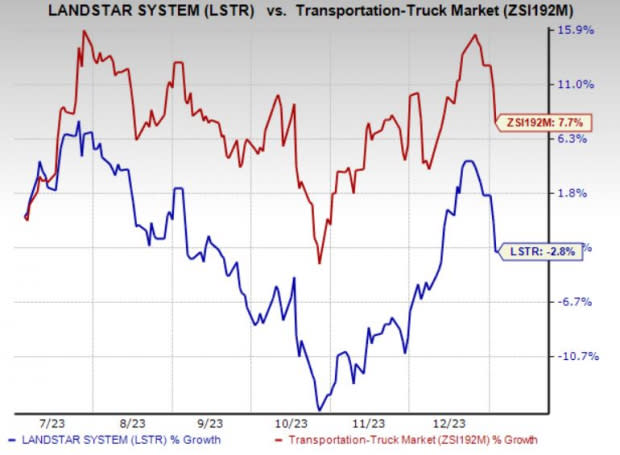

Unimpressive Price Performance: LSTR has lost 2.8% over the past six months compared with its industry’s 7.7% growth.

Image Source: Zacks Investment Research

Other Headwinds: Landstar is being hurt by weak freight conditions. Inflation-related woes have resulted in reduced consumer demand for goods. This, in turn, is affecting freight volumes.

Additionally, escalating operating expenses, primarily due to a rise in purchased transportation costs and fuel prices, pose a threat to the company's bottom line. Increasing expenses are putting pressure on the margins. Driver shortage continues to be a major challenge faced by the trucking industry.

Bearish Industry Rank: The industry, to which LSTR belongs, currently has a Zacks Industry Rank of 240 (of 250 plus groups). Such an unfavorable rank places it in the bottom 5% of the Zacks industries. Studies show that 50% of a stock price movement is directly related to the performance of the industry group it belongs to.

A mediocre stock within a strong group is likely to outclass a robust stock in a weak industry. Therefore, reckoning the industry’s performance becomes imperative.

Stocks to Consider

Some better-ranked stocks from the Zacks Transportation sector are Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation WAB and SkyWest, Inc. SKYW. Each stock presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wabtec has an expected earnings growth rate of 22.43% for the current year. WAB delivered a trailing four-quarter earnings surprise of 7.11%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have gained 27.2% year to date.

SkyWest's fleet-modernization efforts are commendable. The Zacks Consensus Estimate for SKYW’s current-year earnings has improved 38.9% over the past 90 days. Shares of SKYW have surged 217.7% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 32.57%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report