Here's Why Investors Should Buy AECOM (ACM) Stock Right Now

AECOM ACM is capitalizing on increased infrastructure spending and a committed focus on digital initiatives, leading to a substantial rise in net service revenues and the growth of its backlog.

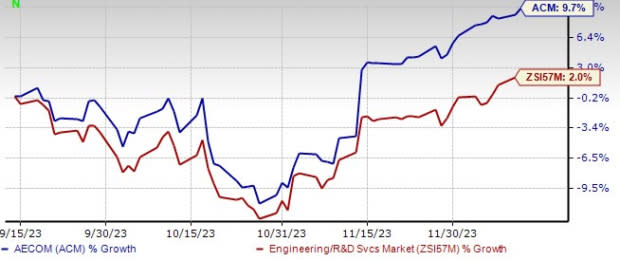

Shares of ACM have gained 7% in the past six months almost at par with the Zacks Engineering - R and D Services industry’s rise of 7.1%. Notably, in the past three months, ACM stock gained 9.7%, handily outperforming the industry’s 2% rise.

Earnings estimates for fiscal 2024 and 2025 have moved 2.3% and 3.4% upward over the past 60 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term. The estimated figure indicates 17.5% and 12.2% year-over-year growth for fiscal 2024 and 2025, respectively.

Image Source: Zacks Investment Research

This Zacks Rank #2 (Buy) company also has a solid long-term earnings growth rate of 14.9%. The stock currently holds a VGM Score of A, supported by a Growth Score of B, a Momentum Score of C and a Value Score of B. Our research shows that stocks with a VGM Score of A or B, along with Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities to investors.

Let’s Delve Into the Major Driving Factors

Strong Backlog Momentum: AECOM continues to demonstrate robust visibility with strong backlogs and pipelines anticipated for the upcoming quarters. In fiscal 2023, the total backlog reached $41.17 billion, reflecting growth from the prior year's $40.18 billion, with a significant 54.8% contribution from contracted backlog growth. Notably, the design contracted backlog for fiscal 2023 recorded a substantial 15% year-over-year increase.

Amidst a favorable funding landscape bolstered by the $1.2-trillion U.S. infrastructure bill, AECOM anticipates a sustained growth trajectory for its backlog.

Digital Innovation Drive: A key focus of AECOM's management is leveraging the company's scale and technical leadership through a streamlined operating model, fostering enhanced collaboration across the organization and driving digital innovation. Resource allocation is directed toward delivering comprehensive solutions to clients and markets.

The company's digital arm, Digital AECOM, equipped with a product portfolio for client digital transformations, is anticipated to play a pivotal role in achieving the targeted 17% segment adjusted operating margin by 2024. For fiscal 2023, an expected 40 basis points year-over-year increase in adjusted operating margin to 14.6% underscores this commitment to digital advancement.

Rising Demand Amid Infrastructure Boost: AECOM is experiencing heightened demand for its technical, advisory, and program management capabilities, aligning with an improved funding environment. The recent approval of the federal infrastructure bill in the United States and an increasing focus on Environmental, Social, and Governance (“ESG”)-related services contribute to the company's optimistic outlook for accelerated revenue growth in fiscal 2024. Maintaining growth across margin, adjusted EBITDA, and adjusted EPS remains a priority.

As part of its strategic priorities, AECOM is directing investments toward ESG initiatives. The company's industry-leading position in green building and design, environmental compliance and remediation, energy efficiency, and infrastructure resilience has been a significant factor in its continued success. This emphasis on ESG aligns with AECOM's strategy, contributing to sustained industry leadership and growth.

Recently, AECOM unveiled its long-term financial framework, underpinned by solid organic growth, a commitment to expand margins, strong free cash flow and an impressive return-based capital allocation policy (read more: AECOM Gives Long-Term Financial Goals, Retains FY24 View).

Commitment to Reward Shareholders: Last month, ACM announced a hike of 22% in its quarterly cash dividend and raised its share repurchase authorization to $1 billion. This well-known infrastructure consulting firm raised the quarterly dividend payout to 22 cents per share from 20 cents, consistent with its commitment to annual double-digit increases in the per-share value. The amount will be paid on Jan 19, 2024, to shareholders of record as of Jan 4.

Other Top-Ranked Stocks From the Construction Sector

EMCOR Group, Inc. EME currently sports a Zacks Rank of 1. Shares of the company have risen 23.3% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 25%, on average. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 12% and 52.8%, respectively, from the previous year’s reported levels.

Acuity Brands, Inc. AYI currently carries a Zacks Rank of 2. AYI delivered a trailing four-quarter earnings surprise of 12%, on average.

The stock has gained 13.6% in the past six months. The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and EPS indicates a decline of 3% and 4.7%, respectively, from a year ago.

Armstrong World Industries AWI currently carries a Zacks Rank #2. AWI delivered a trailing four-quarter earnings surprise of 7.9%, on average.

Shares of the company have gained 36.1% in the past six months. The Zacks Consensus Estimate for AWI’s 2023 sales and EPS indicates growth of 4.7% and 8.2%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report