Here's Why Investors Should Buy SkyWest (SKYW) Stock Now

SkyWest, Inc. SKYW performed well in the past year and has the potential to sustain the momentum in future. If you haven’t taken advantage of its share price appreciation yet, it’s time to do so.

Let’s take a look at the factors that make the stock a strong investment pick at the moment.

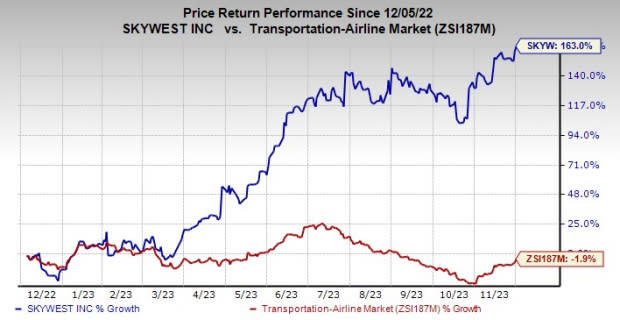

An Outperformer: A glimpse at the company’s price trend reveals that its shares have rallied 163% in the past year against the industry 1.9% decline.

Image Source: Zacks Investment Research

Solid Rank & VGM Score: SkyWest currently carries a Zacks Rank #2 (Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. Thus, the company seems to be an appropriate investment proposition at the moment.

Northward Estimate Revisions: Three estimates for 2023 earnings moved north in the past 60 days and one moved south, reflecting analysts’ confidence in the stock. The Zacks Consensus Estimate for 2023 earnings has moved north 38.8% in the past 60 days.

Positive Earnings Surprise History: SkyWest has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed in one, delivering an average surprise of 32.6%.

Driving Factors: SkyWest's fleet-modernization efforts are commendable. In a bid to modernize its fleet, SkyWest entered into an agreement with Delta to add two E175 aircraft in the fourth quarter of 2023 and one in 2024. In third-quarter 2023, SKYW inked a deal with United Airlines for 19 new E175 jets.

Deliveries of the planes are scheduled to begin from late 2024 and continue till 2026. By 2026-end, SkyWest is likely to operate a total of 258 E175 aircraft.

We are impressed by SKYW's efforts to reward its shareholders through buybacks. The company has repurchased 9.6 million shares in the first nine months of 2023.

Other Stocks to Consider

Some other top-ranked stocks for investors interested in the Zacks Transportation sector are Air Canada ACDVF and Wabtec Corporation (WAB).

Air Canada currently sports a Zacks Rank #1 (Strong Buy). An uptick in passenger traffic is aiding ACDVF. Recently, management announced its plans to launch a new year-round route between Montreal and Madrid. You can see the complete list of today’s Zacks #1 Rank stocks here.

The service will commence in May of the following year as part of its expanded international summer 2024 flying schedule to cater to increased demand.

Wabtec has an expected earnings growth rate of 22.02% for the current year. WAB delivered a trailing four-quarter earnings surprise of 7.11%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 5.1% over the past 90 days. Shares of WAB have risen 17.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Air Canada (ACDVF) : Free Stock Analysis Report