Here's Why Investors Should Buy TopBuild (BLD) Stock Right Now

TopBuild Corp. BLD has been reaping benefits from acquisition-related synergies, fixed cost leverage, strong commercial performance and the ongoing success in managing inflation. A favorable mix of installation business is a major tailwind.

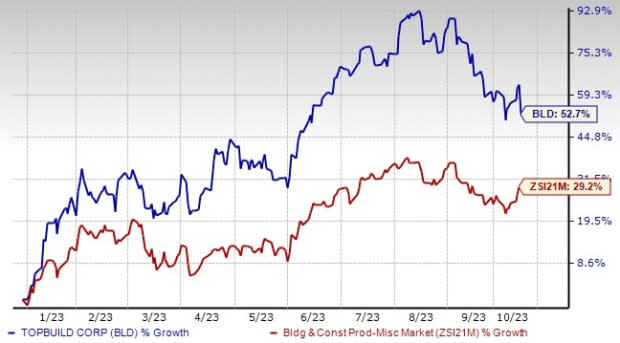

Shares of this installer and distributor of insulation and building material products have surged 52.7% year to date, outperforming the Zacks Building Products - Miscellaneous industry’s 29.2% growth. Its earnings topped the Zacks Consensus Estimate in all the trailing four quarters, the average being 14.1%.

Earnings estimate for 2023 has moved up to $18.55 per share from $17.90 in the past 60 days. Despite the macroeconomic uncertainties and supply-related risks, the stock portrays a positive trend, indicating robust fundamentals and elevating the expectation of ongoing outperformance in the near term.

TopBuild — a Zacks Rank #2 (Buy) stock — has a favorable VGM Score of A. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities to investors.

Image Source: Zacks Investment Research

Let’s Delve Into the Major Driving Factors

Acquisition: Acquisitions play a crucial role in TopBuild's growth strategy, complementing its organic expansion and broadening its reach into new markets and product offerings. During the first half of 2023, TopBuild successfully acquired three residential insulation companies. These acquisitions encompass SRI Holdings, bolstering the company's presence in Georgia, Michigan, Ohio, Florida, Alabama, and South Carolina; Best Insulation, which extends its footprint into thriving regions in the Southeast and Southwest, such as Florida, Texas, and Arizona; and Rocky Mountain Spray Foam, based in Colorado.

Looking ahead for the year, TopBuild anticipates that these acquisitions will contribute an estimated $170 million in additional revenues, further strengthening the company's market position and overall growth prospects.

Going forward, acquisitions remain BLD's primary focus for capital allocation and growth strategy, with a healthy pipeline of outstanding potential partners.

Solid Operating Model: Operational efficiencies, fixed cost leverage and the ongoing success in managing inflation have been aiding the company. The company remains focused on driving top-line growth and improving operational efficiencies. Meanwhile, the company remains committed to its long-term outlook.

In second-quarter 2023, the company’s sales increased 3.4%, adjusted earnings per share grew 18.5% and adjusted operating margin and adjusted EBITDA margin expanded 190 bps each from the prior-year period’s levels. The impressive margin expansion led to increased profitability, depicting a flexible operating model and its ability to quickly reduce costs.

Strong Commercial Performance: The company has been gaining from the strength of its operating model with outstanding multifamily and commercial execution. Its new LeadApp continues to identify commercial opportunities, and installation branch managers are aggressively pursuing these projects. Their focus resulted in a 22.6% increase in commercial revenues in the second-quarter 2023.

Higher ROE: TopBuild’s trailing 12-month return on equity (ROE) is indicative of its growth potential. The company’s ROE of 29.8% compares favorably with the industry’s 6.8%, which signals more efficiency in using shareholders’ funds than peers.

Other Key Picks

EMCOR Group, Inc. EME presently flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 17.2%, on average. Shares of EME have risen 39.5% YTD. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for EME’s 2023 sales and EPS suggests growth of 11.3% and 35.4%, respectively, from the year-ago period’s levels.

Installed Building Products, Inc. IBP currently flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 5.5%, on average. Shares of IBP have risen 37.2% YTD.

The Zacks Consensus Estimate for IBP’s 2023 sales and EPS suggests growth of 4.7% and 8.6%, respectively, from the year-ago period’s levels.

Fluor Corporation FLR currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 6.8% YTD.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report