Here's Why Investors are Buying HCA Healthcare (HCA) Stock Now

HCA Healthcare, Inc. HCA is well-poised to grow on the back of expanding patient volumes and growing admissions. Its inorganic growth strategy and same-store facility figures are also encouraging.

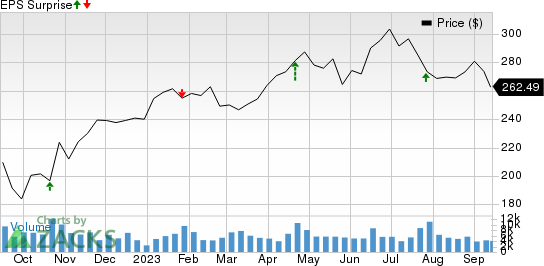

Over the past year, shares of HCA Healthcare have gained 25.6%, outperforming the industry’s 19.7% growth. Headquartered in Nashville, TN, HCA operates general and acute care hospitals. It has a market cap of $71 billion.

Solid Rank & VGM Score

HCA currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. Thus, the company seems to be an appropriate investment proposition at the moment.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s delve deeper.

The Zacks Consensus Estimate for HCA Healthcare’s current-year earnings is pegged at $18.44 per share, which has witnessed one upward estimate revision in the past 30 days against none in the opposite direction. The estimate indicates 9.2% year-over-year growth. HCA Healthcare beat on earnings in three of the last four quarters and missed once, with an average surprise of 5.4%.

HCA Healthcare, Inc. Price and EPS Surprise

HCA Healthcare, Inc. price-eps-surprise | HCA Healthcare, Inc. Quote

The consensus mark for current-year revenues is pegged at $63.9 billion, signaling a 6% year-over-year increase. The company’s operating strength is enabling it to rise above multiple headwinds like stuffing challenges.

We expect its Managed Medicare and Medicaid operations to witness nearly 13% and 14% year-over-year increase, respectively, in 2023, which will support the top-line growth. Managed Care & Insurers operations have also witnessed growth in the first half of this year, following last year’s 3.9% decline. We expect it to increase nearly 7% in 2023.

Our estimate for 2023 equivalent admissions suggests an almost 5% year-over-year increase. Inpatient revenues per admission witnessed significant growth in the second quarter. Although the growth rate will likely decrease a bit in the second half, the full-year rate is expected to be higher than a year ago.

Moreover, our estimate for inpatient and outpatient surgery cases for 2023 signals around a 2% year-over-year increase each. As seniors have resumed delayed elective procedures, demand for services provided by companies like HCA is expected to rise, which will drive patient volumes.

Risks

Despite the upside potential, investors should keep an eye out for its expenses, which have been rising for the past few years and constraining its bottom line from reaching its full potential. Staffing challenges, although rapidly decreasing, still can keep expenses high. We expect total costs to rise nearly 6% in 2023.

Other Key Picks

Some other top-ranked stocks in the broader Medical space are Select Medical Holdings Corporation SEM, Tenet Healthcare Corporation THC and Atai Life Sciences N.V. ATAI, each carrying a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Select Medical’s 2023 earnings indicates a 56.9% year-over-year increase to $1.93 per share. It has witnessed one upward estimate revision over the past month against no movement in the opposite direction. The consensus mark for SEM’s 2023 revenues indicates 4.2% growth from a year ago.

The Zacks Consensus Estimate for Tenet Healthcare’s 2023 bottom line is pegged at $5.73 per share, which rose 2.3% in the past 60 days. During this time, THC has witnessed four upward estimate revisions against none in the opposite direction. It beat earnings estimates in all the last four quarters, with the average surprise being 25.9%.

The Zacks Consensus Estimate for Atai Life Sciences’ current-year earnings implies a 16.3% improvement from the year-ago reported figure. It has witnessed two upward estimate revisions over the past month against no movement in the opposite direction. ATAI beat earnings estimates in two of the last four quarters, met once and missed on one occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

atai Life Sciences N.V. (ATAI) : Free Stock Analysis Report