Here's Why Investors Should Consider Betting on Chubb (CB) Now

Chubb Limited’s CB compelling portfolio, strong renewal retention, positive rate increases, strategic initiatives to fuel profitability, solid capital position and favorable growth estimates make it worth adding to one’s portfolio.

Being one of the world’s largest providers of property and casualty (P&C) insurance and reinsurance, and the biggest publicly traded P&C insurer based on market capitalization, CB has a decent record of beating estimates.

Earnings Surprise History

Chubb’s earnings beat estimates in three of the last four quarters, while missing in one, the average being 6.51%.

Return on Equity

Return on equity of Chubb was 14.3% in the trailing 12 months, which expanded 240 basis points year over year and was better than the industry average of 7.1%.

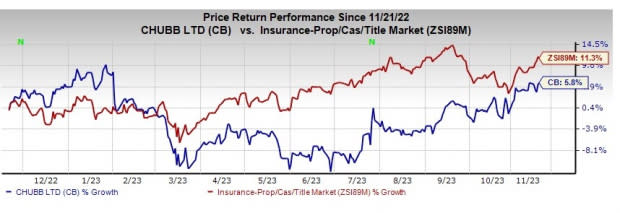

Zacks Rank & Price Performance

Chubb currently carries a Zacks Rank #2 (Buy). Over the past year, the stock has gained 5.8% compared with the industry’s rise of 11.3%.

Image Source: Zacks Investment Research

Optimistic Growth Projections

The Zacks Consensus Estimate for CB’s 2023 earnings is pegged at $19.18 per share, indicating a 25.8% increase from the year-ago reported figure on 10.6% higher revenues of $49.13 billion. The consensus estimate for 2024 earnings is pegged at $20.59 per share, indicating a 7.3% increase from the year-ago reported figure on 7.2% higher revenues of $52.69 billion.

The expected long-term earnings growth is pegged at 10%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2023 and 2024 has moved 4.3% and 6.9% north, respectively, in the past 30 days, reflecting analyst optimism.

Style Score

The company has a VGM Score of B. VGM Score helps identify stocks with the most attractive value, best growth and the most promising momentum.

Back-tested results show that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best opportunities in the value investing space.

Business Tailwinds

Premiums should continue benefiting from strong commercial businesses, commercial P&C rate increases, improving underwriting margins, new business and strong renewal retention. Chubb has an extensive local presence globally. Its several distribution agreements have expanded its network, thus boosting its market presence.

Chubb’s growth strategy includes an increased focus on capitalizing on the potential of middle-market businesses (both domestic and international), along with enhancing the traditional core package and specialty products.

CB has been focused on expanding its presence in the Asia Pacific region. The acquisition of the life and non-life insurance companies of Cigna Corporation in seven Asia Pacific markets testifies to this strategic effort. The addition of Cigna’s business will boost Chubb’s A&H business and expand its Asia life insurance presence.

With an improving rate environment, a solid investment portfolio and a positive operating cash flow, investment income is poised to grow. Chubb estimates adjusted net investment income between $1.435 billion and $1.45 billion and continued growth thereafter.

The insurer’s strong capital position with cash generation capabilities helped it increase dividends for the last 30 years. The dividend yield is 1.5%, better than the industry average of 0.3%. CB has $4.4 billion remaining under its share buyback authorization.

CB has a Value Score of B, reflecting an attractive valuation of the stock.

Other Stocks to Consider

Some other top-ranked stocks from the property and casualty insurance industry are Mercury General Corporation MCY, Kinsale Capital Group, Inc. KNSL and Cincinnati Financial Corporation CINF. While Mercury General sports a Zacks Rank #1, Kinsale Capital and Cincinnati Financial carry a Zacks Rank #2 each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mercury General beat estimates in two of the last four quarters and missed in the other two, the average being 2,833.05%. In the past year, the insurer has lost 1.8%.

The Zacks Consensus Estimate for MCY’s 2023 and 2024 earnings per share indicates a year-over-year increase of 65.2% and 343.7%, respectively.

Kinsale Capital has a solid track record of beating earnings estimates in each of the last four quarters, the average being 14.25%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings has moved 2.7% and 1.7% north, respectively, in the past 30 days, reflecting analysts’ optimism.

Cincinnati Financial surpassed earnings in three of the last four quarters and missed in one, the average being 38.33%. In the past year, the insurer has lost 1.6%.

The Zacks Consensus Estimate for CINF’s 2023 and 2024 earnings has moved 2.6% and 0.3% north, respectively, in the past seven days, reflecting analysts’ optimism.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Mercury General Corporation (MCY) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report