Here's Why Investors Should Hold Labcorp (LH) Stock for Now

Laboratory Corporation of America Holdings LH, or Labcorp, is well-poised to grow in the coming quarters, backed by its expansion efforts into high-growth areas. The company boasts a robust pipeline of potential hospital and local laboratory acquisitions, which present ample opportunities for its growth. The Fortrea spin-off should help the company drive sustainable and profitable growth, effectively meet customer needs and deliver attractive shareholder returns.

However, adverse currency fluctuations and unfavorable solvency remain concerning for the company.

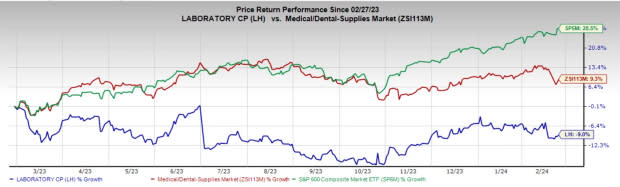

In the past year, this Zacks Rank #3 (Hold) stock has decreased 9% against the 9.3% rise of the industry and a 28.5% increase of the S&P 500 composite.

The renowned healthcare diagnostics company has a market capitalization of $18.61 billion. Labcorp has an earnings yield of 6.72% compared to the industry’s 5.29%. In the last reported quarter, the company delivered an average earnings surprise of 0.30%.

Let’s delve deeper.

Factors at Play

Strategic Development in High-Growth Areas: Labcorp is focused on expanding more into key areas such as oncology, women’s health, autoimmune disease and neurology. The Labcorp Plasma Focus test advanced the company’s precision oncology test suite, allowing oncologists to better evaluate tumor cells and manage patient care through a precision therapy plan.

The company became the first to commercially avail of the ATN Profile, a blood-based test that helps determine the presence or absence of key biological changes consistent with Alzheimer's disease pathology. In addition, Labcorp is well-placed for long-term success in Cell & Gene Therapy, expanding into the consumer market and international growth through the specialty testing and biopharma business. Alongside this, Labcorp has been making impactful digital solutions to improve consumer engagement with the company.

Image Source: Zacks Investment Research

Driving Growth Through Partnerships: The momentum from the health systems and regional local lab partnership strategy remained strong for Labcorp in the fourth quarter of 2023. Labcorp announced a strategic partnership with Baystate Health to acquire its outreach laboratory business and select operating assets. It also completed the acquisition of select assets from Legacy Health and currently manages Legacy's inpatient hospital laboratories, serving patients throughout Oregon and Southwest Washington.

Further, Laborp’s family health solution, Ovia Health, unveiled a new Fertility and Family Building Benefit that will allow companies and health plans to provide comprehensive and customizable solutions to employees and members to support their family-building needs. Earlier, in 2023, LH forged a strategic partnership with Tufts Medicine — a leading integrated academic health system in Massachusetts — and with Jefferson Health, one of the largest health systems serving the Greater Philadelphia area in Southern New Jersey.

A Spin-off of the CDSS Business to Add More Value: In 2023, Labcorp successfully spun off its CDCS business as Fortrea to offer Phase I-IV clinical trial management, market access and technology solutions to pharmaceutical and biotechnology organizations. Both companies expect to have strong strategic flexibility and an operational focus on pursuing specific market opportunities and better meeting customer needs, focused capital structures and capital allocation strategies to drive innovation and growth. This also provides a more targeted investment opportunity for different investor bases and the ability to align its particular incentive compensation with its financial performance.

Downsides

Debt Profile: At the end of the fourth quarter of 2023, Labcorp had short-term borrowings and the current portion of the long-term debt of $999.8 million, while cash and cash equivalents stood at $536.8 million. This raises our concern about the company’s ability to meet its immediate debt obligations.

Exposed to Currency Headwind: With Labcorp deriving a huge share of its revenues internationally, it remains highly exposed to currency fluctuations. With the recent upward trend observed in the value of the U.S. dollar, further acceleration expected by analysts in this value will cause the company’s revenues to face a tough situation overseas.

Estimate Trend

In the past 30 days, the Zacks Consensus Estimate for Labcorp’s 2024 earnings has moved north from $14.61 to $14.73.

The Zacks Consensus Estimate for 2024 revenues is pegged at $12.79 billion, suggesting a 0.8% drop from the 2023 comparable figure.

Key Picks

Some better-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA.

Cardinal Health has a long-term estimated earnings growth rate of 15.9% compared with the industry’s 11.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%. Its shares have increased 39.6% compared with the industry’s 9.3% rise in the past year.

CAH sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stryker, carrying a Zacks Rank #2 (Buy) at present, has an earnings yield of 3.39% against the industry’s -0.89%. Shares of the company have increased 35.2% compared with the industry’s 7.2% rise over the past year.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.09%. In the last reported quarter, it delivered an average earnings surprise of 5.81%.

DaVita, sporting a Zacks Rank #1 at present, has an estimated long-term earnings growth rate of 12.1% compared with the industry’s 11.5%. Shares of DVA have rallied 51.2% compared with the industry’s 12.7% rise over the past year.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%. In the last reported quarter, it delivered an average earnings surprise of 22.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Labcorp (LH) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report