Here's Why Investors Should Hold Red Rock Resorts (RRR) Now

Red Rock Resorts, Inc. RRR is benefiting from robust spending per visit across its portfolio, strategic project investments and cost-saving initiatives. However, a rise in labor and commodity costs as well as softer casino demand in the Las Vegas operations remain a concern.

The Zacks Rank #3 (Hold) company’s 2023 earnings is expected to witness a decline of 62.9%. However, its 2024 earnings and sales are likely to witness 17.9% and 10.5% growth year over year, respectively.

Let’s delve deeper.

Growth Drivers

The company has witnessed strong spending per visit across its portfolio for some time now. Attributes such as strong and consistent visitation from guests (including a younger demographic), increased spending per visit, more time spent on gaming devices and a return of core customers have been adding to the positives. Also, it reported growth in food and beverage, and hotel segments fueled by higher average checks and strength in the catering business. RRR intends to focus on business optimization and cost-reduction measures to drive growth.

Also, emphasis on expansion of new amenities bodes well. During second-quarter 2023, management announced the opening of Polaris, a high-end casino bar located at Green Valley Ranch Resort, and reported solid customer feedback with respect to the same.

During the third-quarter 2023 earnings call, RRR announced the successful opening of Stoney's North Forty bar, a new poker room and a new high-limit slot room in its Santa Fe Station property, along with Game On sports bar in its Boulder Station property. Red Rock Resorts also stated its intention to continue its investments in additional amenities, which include the opening of new high-limit slot and table rooms at its Green Valley Ranch properties in later 2023.

On the other hand, its performance continues to benefit from several initiatives, namely, streamlining of operations, optimization of marketing initiatives, and renegotiating vendor and third-party agreements.

Management focuses on divestitures to drive growth. In 2022, it permanently closed its Texas Station, Fiesta Henderson, Fiesta Rancho and Wild West properties. It intends to divest certain land parcels to reposition its real estate portfolio for growth at Station Casinos. In 2022, the company sold approximately 113 acres for $118 million in proceeds.

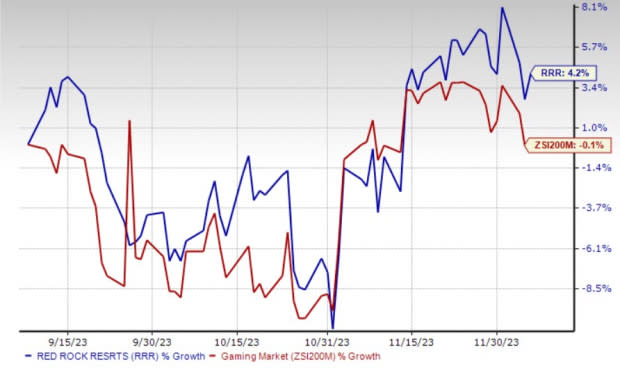

The stock has risen 4.2% against the industry’s decline of 0.1%.

Image Source: Zacks Investment Research

Concerns

A rise in labor and commodity costs continues to hurt Red Rock Resorts. During the second quarter, it witnessed impacts of inflation, increased energy costs and rising interest rates. It also reported price inflation in ordinary goods and services such as food costs, supplies, energy costs and construction costs.

During the third quarter, food and beverage expenses increased 4.4% year over year to $57.7 million. The company intends to focus on cost controls and price adjustments to counter the same.

Although Red Rock Resorts derives a significant portion of its business from Las Vegas, uncertainty in the economic environment remains a concern. The unemployment rate in the Las Vegas metropolitan region inched down to 5.7% in September 2023 from 5.8% in September 2022.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 107% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have increased 15.5% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests an improvement of 28.6% and 132.8%, respectively, from the prior-year levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have jumped 36.8% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS implies a climb of 8.2% and 44.5%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report