Here's Why Investors Should Invest in Abbott (ABT) Stock Now

Abbott Laboratories ABT is gaining from its strategic global expansion to address the unmet demand for advanced medical technologies. Within Core Diagnostics, the company is gaining market share following the end of the public health emergency, particularly in the United States and Europe region. However, forex woes and lower COVID sales impede growth.

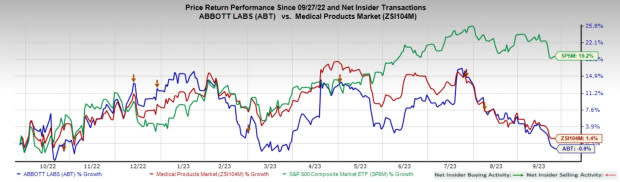

In the past year, this Zacks Rank #2 (Buy) stock has declined 0.9% compared with a 1.4% rise of the industry and a 19.2% rise of the S&P 500 composite.

This renowned provider of a diversified line of healthcare products has a market capitalization of $169.15 billion. The company projects a 5.1% growth for the next five years and expects to maintain its strong performance. Abbott’s earnings surpassed estimates in all of the trailing four quarters, the average surprise being 12.44%.

Let’s delve deeper.

Factors at Play

Strong Prospects Within Core Diagnostics: Abbott is expanding the Diagnostics business foothold (consisting of nearly 30% of the company’s total revenues in the second quarter of 2023). In the past few quarters, there has been a decline in demand for Abbott’s rapid diagnostic tests to detect COVID-19, primarily offset by higher growth across other businesses. Abbott is experiencing increased demand for routine diagnostic testing in the United States and Europe. In the United States, Abbott is registering strong growth within the blood transfusion testing business, consistently recovering from lower plasma donations during the COVID-19 pandemic.

Sales Recovery Within Nutrition: Following the massive setback related to the voluntary recall and production stoppage of certain infant powder formula products manufactured at its facility in Sturgis, MI, last year. Abbott’s Nutrition business has started showing signs of recovery since the beginning of 2023. Per the last update on the second-quarter earnings call, the company has made good progress in increasing manufacturing production. It has now recovered approximately 75% of the market share in the infant formula business.

Stable Liquidity Position: With total debt (including the current portion) of $16.85 billion as of Jun 30, 2023, Abbott looks quite comfortable from the liquidity point of view. The company’s cash and cash equivalents were $8.16 billion at the end of second-quarter 2023. Although the second quarter’s total debt was much higher than the corresponding cash and cash equivalent level, the company has $2.28 billion of short-term payable debt on its balance sheet, much lower than the short-term cash level.

Further, in each of the first two quarters of 2023, Abbott declared a quarterly dividend of 51 cents per share on its common shares, indicating an increase of 8.5% from 47 cents declared in each of the first two quarters of 2022.

Downsides

Declining COVID Testing Dents Growth: Through the last few months of 2022 and following the official ending of the public health emergency in May, Abbott is experiencing a persistent decline in COVID testing-related demand. Through the first six months of 2023, Abbott’s Rapid Diagnostics sales plunged 67.9% from the year-ago period’s levels due to lower demand for COVID-19 tests.

Image Source: Zacks Investment Research

Foreign Exchange Translation Impacts Sales: Foreign exchange is a significant headwind for Abbott due to a considerable percentage of its revenues coming from outside the United States. The strengthening of the euro and some other developed market currencies has constantly been hampering the company’s performance in the international markets.

In the second quarter, foreign exchange had an unfavorable year-over-year impact of 2.5% on sales.

Estimate Trends

In the past 90 days, the Zacks Consensus Estimate for earnings has been constant at $4.40.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $39.77 billion, suggesting an 8.9% decline from the year-ago quarter’s reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 19.1% against the industry’s 0.4% decline in the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 3.4% against the industry’s 4% decline in the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 28.5% compared with the industry’s 4.2% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report