Here's Why Investors Should Invest in GATX Stock Right Now

GATX Corporation GATX is benefiting from its shareholder-friendly initiatives through which it rewards its shareholders in the form of dividend payments and share repurchases.

Against this backdrop, let’s look at the factors that make this stock an attractive pick.

What Makes GATX an Attractive Pick?

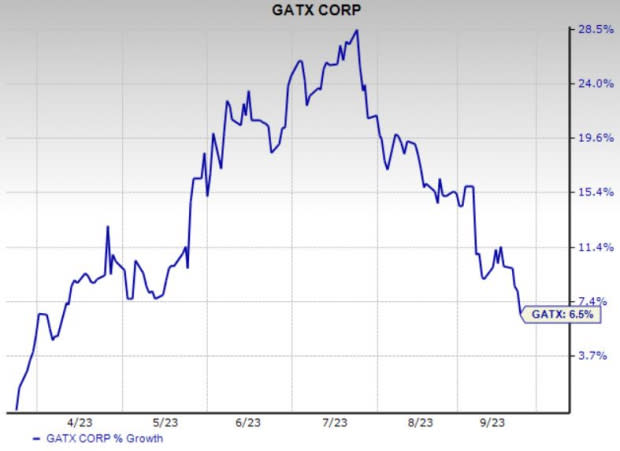

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. Shares of GATX have gained 6.5% over the past six months.

Image Source: Zacks Investment Research

Solid Zacks Rank: GATX has a Zacks Rank #2 (Buy). Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2 offer the best investment opportunities. Thus, the company is a compelling investment proposition at the moment.

Northward Estimate Revisions:The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 90 days, the Zacks Consensus Estimate for GATX’s third-quarter 2023 earnings has moved up 4.1% year over year. Over the past 90 days, the Zacks Consensus Estimate for GATX’s 2023 and 2024 earnings has increased 2.1% and 1.3%, year over year, respectively.

Positive Earnings Surprise History: GATX has an impressive earnings surprise history. The company delivered an earnings surprise of 17.30% in the last four quarters, on average.

Earnings Expectations: Earnings growth and stock price gains often indicate a company’s prospects. For third-quarter 2023, GATX’s earnings are expected to grow 36.61% year over year. For 2023 and 2024, GATX’s earnings are estimated to grow 14.33% and 1.10%, year over year, respectively.

Growth Factors:The gradual improvement in the North American railcar leasing market is aiding GATX’s top line. Demand for the majority of railcar types in GATX's fleet remains robust, and absolute lease rates have been increasing. For 2023, GATX anticipates the railcar leasing environment in North America to remain favorable. GATX expects current-year earnings to be at the upper end of or modestly exceed the previously announced guidance range of $6.50–$6.90 per diluted share. We are also upbeat about GATX's measures to reward its shareholders through dividends and buybacks despite coronavirus-led woes.

Other Stocks to Consider

Some other top-ranked stocks for investors interested in the Zacks Transportation sector are Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB) and SkyWest, Inc. (SKYW). Each stock currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wabtec has an expected earnings growth rate of 16.87% for the current year. WAB delivered a trailing four-quarter earnings surprise of 3.42%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have soared 5.9% year to date.

SkyWest's fleet-modernization efforts are commendable. A fall in operating expenses is a tailwind for SkyWest. In second-quarter 2023, the metric dipped 2.4% to $693.8 million due to a decline in operating costs. Low operating expenses boost bottom-line results. Shares of SKYW have surged 155.4% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 31.51%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report