Here's Why Investors May Bet on BioMarin (BMRN) Stock Now

BioMarin Pharmaceutical Inc. BMRN develops treatments for serious life-threatening medical conditions, mainly affecting children. The company’s top line is currently being driven by strong demand for its marketed products, especially new dwarfism drug, Voxzogo. Also, the recent approval of Roctavian (valoctocogene roxaparvovec, or valrox), a gene therapy for treating adults with severe hemophilia A, has opened up a key sales opportunity.

BioMarin has an attractive early-stage pipeline primarily focusing on gene therapies.

Here are some reasons why investors should consider betting on BioMarin stock.

Good Rank, Rising Share Price and Estimates: BioMarin currently has a Zacks Rank #1 (Strong Buy).

In the past 60 days, estimates for BioMarin’s 2024 earnings per share have risen from $3.07 to $3.15.

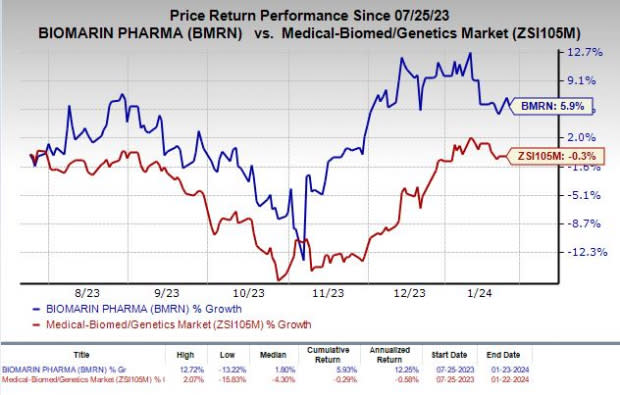

The stock has rallied 5.9% in the past six months against the industry’s decline of 0.3%.

Image Source: Zacks Investment Research

Voxzogo - A Key Revenue Driver: Since its launch, Voxzogo has seen rapid sales uptake driven by strong prescription demand. Voxzogo became the first medicine for treating achondroplasia, the most common form of dwarfism, following its approval in the United States and Europe in 2021.

In the first nine months of 2023, Voxzogo generated sales worth $324.1 million, reflecting a significant increase year over year. Sales of the drug are being driven by continued global market expansion and rapid patient uptake across all regions. BioMarin is seeking approvals for the drug across multiple new markets, which will boost sales of the drug in 2024 and beyond.

The company plans to start a pivotal registrational study on Voxzogo for a new indication — hypochondroplasia — a condition characterized by impaired bone growth shortly. Also, BioMarin is preparing to initiate two additional clinical programs in 2024 evaluating Voxzogo in idiopathic short stature and genetic short stature conditions, respectively.

Focus on Gene Therapy Space & Other Pipeline Progress: Roctavian is the first and only one-shot gene therapy approved for treating adults with severe hemophilia A in the United States and Europe. A rare genetic blood disorder, hemophilia A, is caused by a missing or defective clotting protein FVIII, which prevents normal blood clotting.

Following the successful launch of Roctavian, BioMarin is actively working to add new gene therapy treatments to its portfolio. The company’s second gene therapy candidate is BMN 331, which is being evaluated in a phase I/II study for the treatment of hereditary angioedema.

This apart, BioMarin is developing BMN 255, a small molecule glycolate oxidase inhibitor, in a phase I/II study for hyperoxaluria in chronic liver disease. Successful development and commercialization of these pipeline candidates will drive the long-term growth of the company.

Other Products Continue to Drive Growth: Sales of its key drug, Vimizim, which is approved for treating mucopolysaccharidosis type IVA (MPS IVA, also known as Morquio syndrome type A), have been rising consistently on a year-over-year basis.

Meanwhile, Palynziq injection, which has been developed to reduce blood phenylalanine (Phe) levels in PKU patients, is witnessing strong commercial uptake in the United States. BioMarin believes the injection has a peak commercial opportunity of roughly $1 billion.

Other products like Naglazyme, which is approved for MPS VI, and Brineura, for CLN2 — a form of Batten disease — are also generating incremental sales.

Other Stocks to Consider

Some other top-ranked stocks in the healthcare sector are Regeneron Pharmaceuticals, Inc. REGN, CytomX Therapeutics, Inc. CTMX and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Regeneron’s 2024 earnings per share have improved from $41.57 to $43.97. In the past year, shares of REGN have rallied 28.8%.

Earnings of Regeneron beat estimates in each of the trailing last four quarters. REGN delivered a four-quarter average earnings surprise of 12.34%.

In the past 60 days, estimates for CytomX Therapeutics’ 2024 loss per share have narrowed from 21 cents to 6 cents. In the past year, shares of CTMX have plunged 38.5%.

CytomX Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. CTMX delivered a four-quarter earnings surprise of 45.44%, on average.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have risen 9.2%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report