Here's Why Investors Must Hold Acuity Brands (AYI) Stock for Now

Acuity Brands, Inc. AYI is benefiting from innovation across its diversified product portfolio, focusing on Intelligent Spaces Group (“ISG”) accompanied by the strategic execution of other initiatives like cost-savings and in-organic steps.

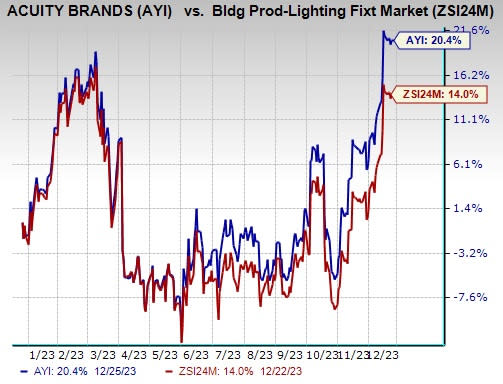

Shares of this manufacturer and distributor of lighting fixtures and related components have risen 20.4% in the past year compared with the Zacks Building Products - Lighting industry’s 14% growth.

The company’s earnings estimates for fiscal 2024 have moved north to $13.39 per share from $13.38 per share over the past 60 days. AYI also delivered a trailing four-quarter earnings surprise of 12%, on average. Furthermore, the growth prospect is solidified with a VGM Score of A, backed by a Value Score of A and a Growth Score of B. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and outperformance in the near term.

Image Source: Zacks Investment Research

However, this Zacks Rank #3 (Hold) company is facing headwinds in the forms of economic uncertainties and high costs.

Appealing Factors of the Stock

Intent Focus on Innovation: Acuity Brands prioritizes innovation initiatives that help it to further expand its diversified portfolio of lighting control solutions and energy-efficient luminaries. It focuses on innovation through product vitality and increasing service levels, which benefits customers and eventually increases growth prospects. During fiscal 2023, the company refreshed 20% of its product portfolio and introduced new product families. Furthermore, the American electric lighting brand launched AutoConnect, a durable solution for outdoor infrastructure lighting, which aligns with the anticipated infrastructure investments, thus positioning AYI for continued success.

The company primarily focuses on strategic supplier relationships, empowering its teams to prioritize access and speed over cost on available components, along with redesigning products to the available components by its highly-skilled engineers. Acuity Brands introduced around 220 new and upgraded lighting and lighting control products in fiscal 2022.

Focus on ISG Bodes Well: This reportable segment of Acuity Brands specializes in providing products and services that enhance the intelligence, safety and sustainability of spaces. ISG witnessed milestones in fiscal 2023 attributable to Distech's strategic focus on expanding the addressable market, which progressed successfully through geographic expansion. Also, AYI’s strategy for Atrius centers around establishing a data layer that bridges the gap between edge and cloud, thus enabling the development of impactful applications for building spaces, added to that milestone achievement.

During the fiscal fourth quarter of 2023, ISG’s net sales grew 17.1% year over year to $71.9 million. This was driven by Distech’s continuous wins in business across new and existing customers accompanied by modest benefits from the acquisition of KE2 Therm.

Strategic Growth Initiatives: Acuity Brands’ consideration of various business-growing strategies like in-organic moves and cost-saving strategies has bode well for its long-term prospects. The company is committed toward expanding its geographic borders and product portfolio through acquisitions and joint ventures, and is also engaged in its portfolio optimization through divestiture to drive growth. During fiscal 2023, it sold Sunoptics prismatic skylights business and discontinued Winona custom architectural lighting solutions.

Furthermore, it engages in ensuring price management to expand its margins and increase profitability prospects. The company's portfolio realignment, alongside ongoing product vitality efforts, has enabled the facilitation of this strategy in this volatile market. The ongoing supply-chain productivity enhancements continue to improve processes and manage costs. The adjusted operating margin of 16.1% in the fourth quarter of fiscal 2023 increased 80 basis points from the year-ago level.

Factors Hindering Growth

Ongoing Economic Uncertainties: Acuity Brands operates in a highly competitive industry, along with thriving on residential and non-residential construction, covering new, reconstruction and retrofit activities. These market aspects are vulnerable to volatility owing to several general business and economic factors, such as gross domestic product growth, employment levels, credit availability and other related factors.

During fourth-quarter fiscal 2023, the company reported net sales of $1.01 billion, down 9% from $1.11 billion reported in the prior-year period. The downside was due to lower sales within the Acuity Brands Lighting and Lighting Controls segment, consistent with lead-time normalization trends and the impact of the wider macro-environment.

High Costs: Acuity Brands is facing supply-chain challenges and rising costs of certain components for some time now. Furthermore, an intensive focus on the innovation of energy-efficient lighting products like LED fixtures requires capital investments, thus increasing cost structure. Moreover, the company is highly committed to acquisitions and joint ventures, which lead to higher costs, thereby pressuring margins.

Key Picks

Here are some better-ranked stocks from the Construction sector.

EMCOR Group, Inc. EME presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 25%, on average. Shares of EME have risen 43.9% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates an improvement of 12% and 52.8%, respectively, from the year-ago level.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 271.8% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Willdan Group, Inc. WLDN currently sports a Zacks Rank of 1. WLDN delivered a trailing four-quarter earnings surprise of a whopping 850.6%, on average. The stock has gained 21.1% in the past year.

The Zacks Consensus Estimate for WLDN’s 2023 sales and EPS indicates growth of 14.1% and 47.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report