Here's Why Investors Must Hold RPM International (RPM) Stock

RPM International Inc. RPM is benefiting from the implementation of the Margin Achievement Plan (“MAP”) 2025 operational improvement initiative and increased infrastructure spending, accompanied by its focus on acquisitions and divestitures.

This Zacks Rank #3 (Hold) company delivered a trailing four-quarter earnings surprise of 8.5%, on average. Earnings estimates for fiscal 2024 have moved north to $5 per share from $4.96 per share over the past 60 days. The company’s uptrend was driven by increased demand for its engineered solutions considering infrastructure and reshoring projects, along with strategic utilization of its competitive advantages.

Furthermore, the company solidifies this growth prospect, with a VGM Score of A, backed by a Value Score of B and a Growth Score of A. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and the continuation of an outperformance in the near term.

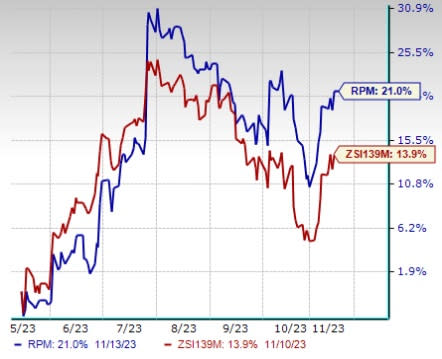

Shares of RPM have increased to 21% in the past six months, outperforming the Zacks Paints and Related Products industry’s 13.9% growth.

Image Source: Zacks Investment Research

However, the high-cost environment and foreign currency risks are hurting the company’s growth prospects.

What Makes the Stock Appealing?

Impressive Q1 Results: RPM International reported better-than-expected first-quarter fiscal 2024 results wherein the earnings and sales topped the Zacks Consensus Estimate by 5.1% and 2.5%, respectively. The bottom and the top lines also grew year over year by 11.6% and 4.1%, respectively. The growth trend was attributable to record-breaking sales in three out of four segments. Organic sales contributed 3.9% and acquisitions added 0.1% to total sales growth in the quarter.

MAP 2025 Initiative: Through this operational improvement initiative, RPM intends to accelerate growth, maximize operational efficiencies and generate superior value for its customers, associates and shareholders. During first-quarter fiscal 2024, with the successful execution of MAP 2025 initiatives, the company reached record-high adjusted EBIT of $309 million, up 12.3% year over year. On the back of increased volume in businesses, thanks to fully leveraging the structural efficiency improvements due to focus on this initiative, the company witnessed margin expansion.

By the end of May 2025, RPM projects to achieve $8.5 billion of annual revenues, 42% gross margin and 16% adjusted EBIT margin.

Solid Infrastructure Spending: RPM’s engineered solutions are witnessing favorable demand patterns, especially in infrastructure and reshoring projects. During the fiscal first quarter of 2024, geographically, the company’s revenue growth was mainly backed by strong sales growth in Africa, the Middle East and Latin America. Sales in Africa, the Middle East and other foreign grew 16.5%, and Latin America increased 15.8% year over year.

Furthermore, North American sales were up 2.7% and Europe sales were up 9.3%, respectively, year over year.

Acquisitions & Divestitures: One of RPM’s primary growth strategies includes accretive acquisitions as well as profitable divestitures. In the first quarter of fiscal 2024, acquisitions, net of divestitures, contributed 0.1% to sales. The company remains focused on prudent strategic growth investments in fiscal 2024. This is expected to improve resiliency, capacity and efficiency.

During fiscal 2023, the company completed six small acquisitions (contributed 0.8% to sales) and the divestiture of Guardian Protection Products, Inc. business for proceeds of approximately $49.2 million.

Factors Marring Growth Prospects

Inflated Costs: RPM International has been witnessing higher costs and expenses related to restructuring, divestitures and labor inflation for some time now. Also, persistent supply-chain disruptions and acquisitions-related expenses are concerns. During the first quarter of fiscal 2024, the company incurred $6.5 million in restructuring costs. It expects wage and raw material inflation to continue into early fiscal 2024.

Foreign Currency Headwinds: A notable portion of its revenues is from RPM’s international businesses. A strengthening dollar or any other global economic uncertainty may affect its operating results.

During the fiscal first quarter, currency headwinds reduced net sales in the Performance Coatings Group and Consumer Group by 0.7% and 0.2%, respectively.

Key Picks

Here are some better-ranked stocks that investors may consider from the Zacks Construction sector.

Installed Building Products, Inc. IBP currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

IBP delivered a trailing four-quarter earnings surprise of 7.3%, on average. Shares of the company have gained 11.1% in the past six months. The Zacks Consensus Estimate for IBP’s 2023 sales and earnings per share (EPS) indicates growth of 4.6% and 8.6%, respectively, from the previous year’s reported levels.

Acuity Brands, Inc. AYI presently flaunts a Zacks Rank of 1. AYI delivered a trailing four-quarter earnings surprise of 12%, on average. Shares of the company have gained 10.5% in the past six months.

The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and EPS indicates decline of 3% and 4.7%, respectively, from the previous year’s reported levels.

Construction Partners, Inc. ROAD currently sports a Zacks Rank of 1. ROAD has a trailing four-quarter earnings surprise of 10.6%, on average. Shares of the company have gained 39.3% in the past six months.

The Zacks Consensus Estimate for ROAD’s fiscal 2024 sales and EPS indicates growth of 14.6% and 47.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RPM International Inc. (RPM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report