Here's Why Investors Should Retain Humana (HUM) Stock Now

Humana Inc. HUM is aided by an expanding membership base, a robust 2023 business outlook, buyouts and collaborations, and a notable financial position.

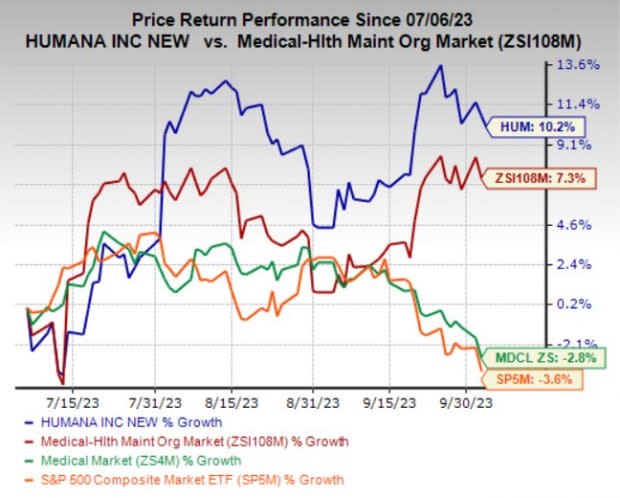

Zacks Rank & Price Performance

Humana currently carries a Zacks Rank #3 (Hold).

The stock has gained 10.2% in the past three months compared with the industry’s 7.3% rise. The Zacks Medical sector has dipped 2.8% and the S&P 500 composite has lost 3.6% in the same time frame.

Image Source: Zacks Investment Research

Favorable Style Score

HUM boasts an impressive VGM Score of A. VGM Score helps identify stocks with the most attractive value, the best growth and the most promising momentum.

Rising Estimates

The Zacks Consensus Estimate for Humana’s 2023 earnings per share (EPS) is pegged at $28.26, suggesting growth of 12% from the prior-year reported figure. The consensus mark for 2024 earnings is pegged at $32.08 per share, indicating an improvement of 13.5% from the prior-year estimate.

HUM’s bottom line outpaced estimates in each of the trailing four quarters, the average surprise being 5.8%.

A Strong View for 2023

Management forecasts adjusted revenues between $104.4 and $106.4 billion for 2023, the midpoint of which suggests 13.5% growth from the 2022 figure.

Adjusted EPS is anticipated to be a minimum of $28.25 in 2023, which indicates an improvement of 11.9% from the 2022 level.

Key Business Tailwinds

Humana gains on the back of an expanding customer base, which it earns through distributing cost-effective health insurance plans across different U.S. communities and making efforts to upgrade such plan offerings from time to time. Humana recently announced its Medicare Advantage plans for 2024 and aims to expand to 39 new counties in 2024. Overall, its Medicare HMO offerings are targeted to reach 140 counties in 2024, while its Medicare LPPO plans are likely to be available across 80 counties in the same time frame.

The strength of these plans fetches numerous contract wins and renewed agreements from federal or state authorities. An increase in membership fetches the benefit of improved premiums, the most significant contributor to a health insurer’s top line.

An aging U.S. population is likely to sustain the solid demand for Medicare plans of Humana. Management estimates individual Medicare Advantage membership to witness a minimum membership growth of 825,000 in 2023. In order to cater more effectively to the aging population, HUM has the CenterWell brand in place.

In August 2023, the health insurer introduced the CenterWell Primary Care Anywhere program to provide enhanced primary care to seniors at home across specific Louisiana and Georgia locations.

A series of acquisitions undertaken over the years have enhanced Humana’s capabilities, diversified income streams, expanded its global presence and widened its customer base. HUM often resorts to collaborations with well-reputed organizations to launch new plans or upgrade features within the existing ones.

Humana boasts a solid cash position and cash-generating abilities, with the support of which it can undertake uninterrupted growth-related initiatives. As of Jun 30, 2023, its cash and cash equivalents of $16.2 billion were way higher than the short-term debt of $2 billion. In the first half of 2023, HUM generated operating cash flows of $9.9 billion, which increased nearly eight-fold year over year.

Stocks to Consider

Some better-ranked stocks in the Medical space are Molina Healthcare, Inc. MOH, The Ensign Group, Inc. ENSG and Medpace Holdings, Inc. MEDP. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The bottom line of Molina Healthcare surpassed estimates in each of the last four quarters, the average surprise being 7.2%. The Zacks Consensus Estimate for MOH’s 2023 earnings and revenues indicates 16% and 3.4% growth, respectively, from their corresponding prior-year actuals. The consensus mark for MOH’s 2023 earnings has moved 0.6% north in the past 60 days.

Ensign Group’s earnings beat estimates in two of the trailing four quarters, matched the mark once and missed on the remaining one occasion, the average surprise being 0.9%. The Zacks Consensus Estimate for ENSG’s 2023 earnings and revenues indicates 14.7% and 22.7% growth, respectively, from the prior-year actuals. The consensus mark for ENSG’s 2023 earnings has moved 0.2% north in the past 30 days.

Medpace’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 22.3%. The Zacks Consensus Estimate for MEDP’s 2023 earnings indicates a rise of 15.3%, while the consensus mark for revenues suggests an improvement of 27.8% from the corresponding year-ago reported figures. The consensus estimate for MEDP’s 2023 earnings has moved 2.1% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report