Here's Why Investors Should Retain ICF International (ICFI) Stock

ICF International, Inc. ICFI has an impressive earning surprise history, beating the Zacks Consensus Estimate of earnings in all four trailing quarters with an average surprise of 4.9%.

ICFI has an impressive Growth Score of B. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

ICFI’s stock has outperformed the Government Services industry, growing 23.7% year to date against its industry’s 7.8% growth and 13.7% growth of the S&P composite.

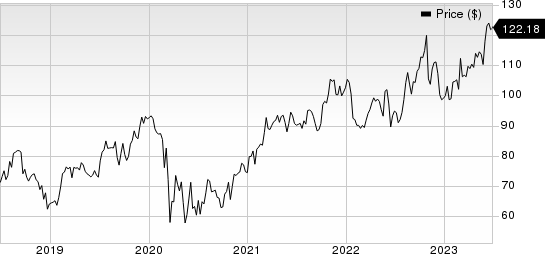

ICF International, Inc. Price

ICF International, Inc. price | ICF International, Inc. Quote

Factors That Auger Well

ICF International is benefiting from the large addressable market, serving 58 regional offices across the United States and 24 offices outside the country. The company serves diverse markets which include energy, environment, infrastructure, air transport, healthcare, interactive technology, marketing and e-commerce. A diversified market enables the company to earn consistent revenues.

The rise in demand for advisory services, increased government focus on environmental initiatives; emphasis on transparency and accountability; efficiency and mission performance management and generational changes are boding well for the company. Technology-based solutions like digital services and strategic communications also provide ample growth opportunities.

ICF International has been active on the acquisition front and the same has been a growth catalyst. The January 2022 acquisition of Creative Systems and Consulting has expanded ICF International’s federal IT modernization/digital transformation capabilities with leading Salesforce and Microsoft implementation teams.

Some Risks

ICF International is tolled with increasing costs driven by investments and acquisitions. The company’s operating costs and expenses increased 16.1% in 2022, 3.9% in 2021 and 5.1% year over year in 2020.

ICFI’s current ratio at the end of first-quarter 2023 was pegged at 1.29, lower than the current ratio of 1.32 reported at the end of the previous quarter and 1.12 reported at the end of the prior-year quarter. A decreasing current ratio indicates that the company will have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

ICFI currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of A along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report