Here's Why Investors Should Retain JAKKS Pacific (JAKK) Now

JAKKS Pacific, Inc. JAKK is capitalizing on its strategic acquisitions, well-established global presence, emphasis on inventive approaches, and partnerships with renowned brands and film franchises. Nonetheless, a decrease in sales within the North American region remains a point of apprehension.

Growth Drivers

JAKKS Pacific has emerged as a diversified consumer products company buoyed by a string of acquisitions over the past several years. We consider the company’s ability to successfully identify, close and integrate acquisitions to be one of its primary competitive advantages. Meanwhile, it has collaborations with Disney, Skechers, Nickelodeon, Cabbage Patch Kids and Chico to manufacture toys and merchandise related to these brands.

JAKK focuses on expanding its reach to include prominent accounts such as Macy's and Amazon in the United States and Sainsbury's in the U.K. In second-quarter 2023, it emphasized upgrading its retail section with Wave 2 movie-specific products, including 5-inch figures, micro figures, and Bowser Castle and Donkey Kong arena playsets.

The company plans for further growth in the third quarter and beyond, with new waves and line extensions already in place. It intends to initiate a full-360 paid media campaign, including digital, social, PR and trade support for new products.

On the other hand, JAKKS Pacific is committed to diversifying its footprint outside the United States. Consistent with its endeavors, it has opened sales offices and expanded distribution agreements for its products. Its partnership with Meisheng is expected to result in robust growth in Asia. During the second quarter of 2023, JAKK’s international business revenues increased 6.9% year over year to $23.9 million.

In response to evolving play patterns among children and the subsequent decline in demand for traditional toys, JAKKS Pacific has consistently introduced innovative elements into its product offerings. The shift toward digital games and electronic learning tools has led to reduced interest in physical toys among younger demographics. Aligning with this shift, the company has integrated a range of mobile gaming apps and digital games into its portfolio, complementing its existing physical toy line. This strategic move positions JAKKS Pacific to capitalize on the burgeoning demand for smartphone gaming.

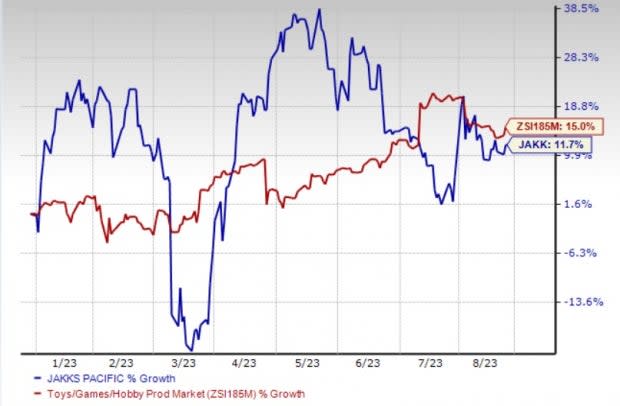

So far this year, the Zacks Rank #3 (Hold) company’s shares have gained 11.7% compared with the industry’s growth of 15%.

Image Source: Zacks Investment Research

Concerns

Yet, JAKK’s performance remains hindered by lackluster sales in the North American region. In the second quarter of 2023, there was a significant year-over-year decline of 27.8% in North America sales, amounting to $143 million.

During second-quarter 2023, the company reported challenges with respect to its outdoor seasonal business. Retailers avoiding large cube items in stores and the overhang from COVID stockpiling (on many items) are adding to the negatives. During the second quarter, revenues from this division plunged 34% year over year. Moving ahead, these challenges are likely to persist in the short term.

Key Picks

Some better-ranked stocks from the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 28.5%, on average. The stock has surged 137% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS implies gains of 54.5% and 180.3%, respectively, from the year-ago period’s levels.

Trip.com Group Limited TCOM flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 147.9%, on average. The stock has increased 36.6% in the past year.

The Zacks Consensus Estimate for Trip.com Group’s 2023 sales and EPS suggests jumps of 104.9% and 537.9%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 42.6%, on average. The stock has improved 20.8% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS indicates rises of 44.5% and 110.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report