Here's Why Investors Should Retain Nordson (NDSN) Stock

Nordson Corporation NDSN is backed by strong customer demand in industrial, consumer non-durable and medical interventional end markets. Though the high cost of sales due to rising inflation and forex woes is weighing on NDSN’s performance, cost-reduction actions support its bottom line.

What’s Aiding NDSN?

Business Strength: Investments in automation, memory and electronic product innovation should drive Nordson’s growth. Also, the company is benefiting from steady demand in industrial, consumer non-durable and polymer processing product lines in the Industrial Precision Solutions segment. For fiscal 2023 (ending October 2023), NDSN expects adjusted earnings of $8.90-$9.30 per share. This compares with the year-ago figure of $8.81 per share.

Benefits From Acquisitions: Acquired assets are strengthening Nordson’s top line. The company acquired CyberOptics Corporation in November 2022 which expanded NDSN’s semiconductor test and inspection capabilities with the help of CyberOptics’ 3D optical sensing technology and wireless measurement sensors. The buyout boosted total revenues by 3% in the fiscal second quarter (ended April 2023).

Rewards to Shareholders: NDSN’s efforts to reward its shareholders through dividend payments and share repurchases are noteworthy. In fiscal 2022 (ended October 2023), Nordson paid out dividends of $125.9 million, up 28.9% year over year. The company also bought back shares worth more than $260 million (compared with $61 million in fiscal 2021) in the same period. In the first six months of fiscal 2023, Nordson paid out dividends of $74.5 million, up 25.6% year over year. In the same period, it bought back shares worth $54.4 million. The quarterly dividend rate was hiked by 27% to 65 cents per share in August 2022. This marked the company’s 59th consecutive year of dividend increase.

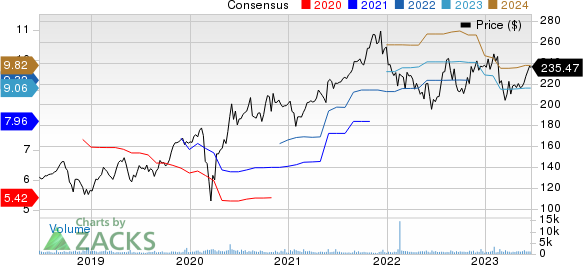

Nordson Corporation Price and Consensus

Nordson Corporation price-consensus-chart | Nordson Corporation Quote

In light of the above-mentioned positives, we believe, investors should retain NDSN stock for now, as suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Ingersoll Rand Inc. IR sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks.

IR delivered a trailing four-quarter earnings surprise of 12.6%, on average. In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 7.1%. The stock has improved 22.7% in the year-to-date period.

Alamo Group Inc. ALG currently sports a Zacks Rank of 1. ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has increased 28.8% in the year-to-date period.

Axon Enterprise AXON sports a Zacks Rank of 1 at present. The company has a trailing four-quarter earnings surprise of 44.4%, on average.

In the past 60 days, estimates for Axon’s 2023 earnings have increased 13%. The stock has rallied 23.4% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report