Here's Why Investors Should Retain Norwegian Cruise (NCLH) Now

Norwegian Cruise Line Holdings Ltd. NCLH is well poised to benefit from solid booking activities, digital initiatives and fleet expansion efforts. Also, strength in advance ticket sales bodes well. However, ongoing inflationary pressures are a concern.

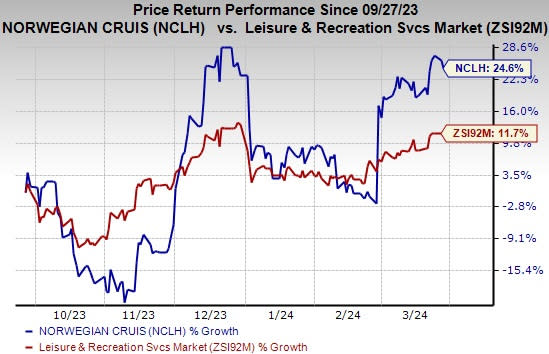

Shares of the company have gained 24.6% in the past six months compared with the Zacks Leisure and Recreation Services industry’s 11.7% growth. The Zacks Consensus Estimate for this currently Zacks Rank #3 (Hold) company's 2024 earnings has increased to $1.25 per share from $1.15 in the past 30 days, solidifying the growth trend.

Image Source: Zacks Investment Research

Let us discuss the factors highlighting why investors should retain the stock for now.

Major Growth Drivers

Strong Booking Activities: Improvements in booking activities have been aiding the company. During the fourth quarter of 2023, the company reported strong consumer demand, achieving record-high bookings and pricing levels during Black Friday and Cyber Monday week. NCLH continues to witness healthy demand across all markets, brands, and products.

As of Dec 31, 2023, the company’s advance ticket sales balance came in at $3.2 billion, reflecting nearly 56% growth from comparable 2019 levels.

The company intends to focus on strategic marketing efforts to drive demand and high-value bookings in the upcoming periods. For 2024, the company expects healthy net yield growth of approximately 5.4% on a constant currency basis on the back of improved occupancy and pricing strength.

Digital Initiatives to Drive Growth: Increased focus on digital initiatives bodes well. Norwegian Cruise is focused on strategically enhancing the guest experience through smart ROI-driven investments and digital innovations across its fleet. The company recently rolled out Starlink high-speed Internet. It swiftly deployed the technology across half of its fleet since spring 2023. NCLH expects to complete the full fleet by 2024-end.

NCLH is enhancing the guest experience on its ships by improving pre-cruise planning and leveraging digital tools across its brands. NCLH recently introduced the Regent onboard mobile app on Seven Seas Grandeur. These enhancements are well-received by guests, offering a smoother experience before, during, and after their cruise while also yielding positive returns.

Focus on Fleet Expansion: Norwegian Cruise is constantly looking to expand its fleet size. It has plans to introduce five more ships through 2028. For the Oceania Cruises brand, the company has one Allura Class Ships to be delivered in 2025. For the Norwegian brand, the company has four Prima Class Ships on order, with scheduled delivery dates from 2025 through 2028. These additions are expected to increase its total Berths to approximately 82,500.

The company’s new build pipeline is likely to pave a path for approximately 28% capacity growth by 2028, registering a CAGR of approximately 5% (from 2023 levels). This signifies the company's long-term strategy to deliver measured capacity growth and optimize the fleet to drive strong financial results.

In 2023, the company added three new world-class ships to its fleet, one for each of its three award-winning brands.

Factors Ailing Growth Prospects

High Costs: Norwegian Cruise has been bearing the brunt of high expenses for quite some time now. During the fourth quarter of 2023, total cruise operating expenses came in at $1.32 billion, up from $1.22 billion reported in the year-ago quarter. The company reported a rise in payroll, fuel and Commissions, transportation and other expenses. NCLH is cautious about increased expenses in terms of fuel and capacity additions. For 2024, our model predicts total cruise operating expenses to rise 6.9% year over year to $5,845 million.

Geopolitical Uncertainties: The company’s operations are likely to be influenced by several geopolitical occurrences, including the Russian invasion of Ukraine and the Israel-Hamas war. The conflict in Israel and the Red Sea led NCLH to cancel and redirect all calls to Israel in the fourth quarter of 2023. Moreover, all calls to Israel and the Red Sea have been canceled and redirected for the entirety of 2024. This impacted occupancy rates for the quarter and year.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Adtalem Global Education Inc. ATGE currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks Rank #1 stocks here.

ATGE has a trailing four-quarter earnings surprise of 16.9%, on average. The stock has gained 19% in the past six months. The Zacks Consensus Estimate for ATGE’s fiscal 2024 sales and EPS indicates an increase of 6.4% and 10.2%, respectively, from the year-ago levels.

Ralph Lauren Corporation RL presently sports a Zacks Rank of #1. RL has a trailing four-quarter earnings surprise of 18.7%, on average. The stock has surged 59.6% in the past six months.

The Zacks Consensus Estimate for RL’s fiscal 2025 sales and EPS suggests growth of 4.2% and 9.5%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H currently sports a Zacks Rank of 2 (Buy). Hyatt has a trailing four-quarter earnings surprise of 17.8%, on average. The stock has increased 54.8% in the past six months.

The Zacks Consensus Estimate for H’s fiscal 2024 sales and EPS calls for growth of 3.5% and 27%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report