Here's Why Investors Should Retain Pool Corp (POOL) Stock

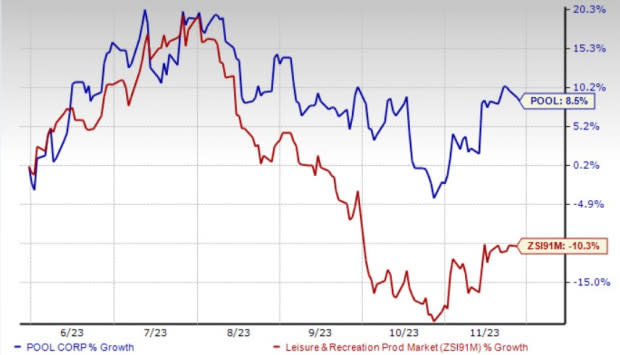

Pool Corporation POOL benefits from solid demand for maintenance and repair activities, and strategic expansions. Consequently, its shares have gained 8.5% against the industry’s decline of 10.3%.

The Zacks Rank #3 (Hold) company’s earnings and revenues in 2024 are likely to witness 3.9% and 7% growth year over year, respectively. However, reduced pool construction and high costs remain concerns.

Growth Drivers

Pool Corp is gaining from solid demand for swimming pool maintenance supplies, above-ground pools, spas and automatic pool cleaners, heaters, pumps, lights, chemicals and filters. Given the products’ importance in repair, replacement, new construction and remodeling activities, continuation of demand will likely support top-line growth in the upcoming periods.

POOL focuses on expansion to drive revenues. It is foraying in newer geographic locations, extending existing markets and launching innovative product categories to boost its market share. To this end, it is also trying to expand through various acquisitions.

In 2022, it boosted its presence in the DIY market segment with the acquisition of Pinch A Penny. POOL stated that it initiated work on chemical sourcing and product management, and that it is reporting brisk store traffic and solid demand across the platform.

In 2021, It boosted its pool distribution network with the addition of Pool Source in the Nashville market (April 2021) and Vak Pak Builders Supply in the Jacksonville market (June 2021).

Pool Corp generates a large portion of its earnings from existing pools. More than half of its gross profits are generated from products related to maintenance and repair of pools while the remainder is derived from the construction and installation of pools and landscaping. Over the past five years, the pool industry has been showing signs of recovery, mostly supported by gradual improvement in remodeling and replacement activities.

Image Source: Zacks Investment Research

Concerns

During the third quarter, the company’s operations were impacted by lower sales volume due to reduced pool construction and deferred discretionary replacement activities. A challenging macroeconomic environment added to the downside. Pool Corp anticipates the softness in construction activities to persist for some time.

For the fourth quarter of 2023, it anticipates quarterly new pool construction sales to decline 5% year over year. In 2023, it expects new pool construction units to fall 30% year over year.

POOL has been witnessing increased expenses lately. Notably, inflationary cost increases in facilities, freight, insurance, IT, advertising and marketing are leading to higher expenses. During the third quarter, operating expenses (as a percentage of net sales) jumped to 15.9% compared with 14.8% in the prior-year period.

During the quarter, operating income plunged 26% year over year to $194.4 million. The operating margin came in at 13.2%, down 310 bps from the prior-year quarter’s level. We believe the company must work hard toward cutting expenses to achieve high margins.

Key Picks

Here are some better-ranked stocks that investors may consider from the Zacks Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 28.3%, on average. The stock has risen 76.4% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) suggests rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc LYV currently flaunts a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 37.5%, on average. The stock has risen 16.2% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates 28.7% and 137.5% climb, respectively, from the year-earlier levels.

Grand Canyon Education, Inc. LOPE presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 9.9%, on average. The stock has risen 21.7% in the past year.

The Zacks Consensus Estimate for LOPE’s 2023 sales and EPS implies an improvement of 7.1% and 17.1%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE) : Free Stock Analysis Report