Here's Why Investors Should Retain ResMed (RMD) Stock for Now

ResMed Inc. RMD is gaining investors’ confidence, backed by the strength of the respiratory care business, led by the ongoing adoption of non-invasive ventilators and life support ventilator solutions. Progress made in terms of several digital health technology initiatives garners appreciation. The company is also well-positioned as the leading global strategic provider of SaaS solutions for outside hospital care globally.

However, ResMed’s balance sheet is burdened with high debt, which is concerning. The unfavorable impacts of global macroeconomic conditions may also affect the company’s results of operations.

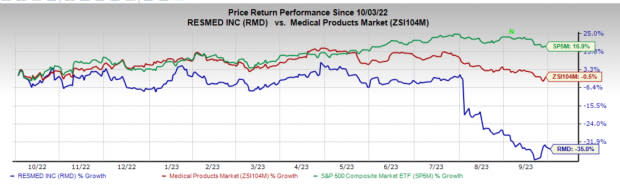

In the past year, this Zacks Rank #3 (Hold) stock has decreased 36% compared with the 0.5% decline of the industry and a 16.9% rise of the S&P 500 composite.

The renowned medical device company has a market capitalization of $21.75 billion. RMD has an earnings yield of 4.75% against the industry’s yield of -1.61%. The company’s earnings surpassed estimates in two of the trailing four quarters, matched once and missed in another quarter. It has an average earnings surprise of 1.64%.

Let’s delve deeper.

Upsides

Respiratory Care Products Continue to Flourish: ResMed’s respiratory care business continues to drive growth and the adoption of bilevel and other non-invasive ventilator solutions worldwide. The company is investing in newer-to-market technologies for patients, including home-based high-flow therapy for treating a chronic obstructive pulmonary disease or COPD at home.

Image Source: Zacks Investment Research

Although still early for market development, ResMed continues to generate clinical evidence and economic outcomes to support the broader adoption of these technology innovations for treating lung disease at home. Given the high incidence of respiratory insufficiency due to COPD and neuromuscular disease, ResMed aims to develop low-cost, high-quality solutions to address this health epidemic.

Potential in Digital Health: ResMed is leading the market in digital health technology, with more than 15.5 billion nights of medical data in the cloud and nearly 21.5 million cloud-connectable medical devices on people's bedside tables in 140 countries worldwide.

In the coming quarters, the company is introducing several artificial intelligence-driven coaching features in the AirView system and on the myAir app. These AI-driven data products will provide personalized suggestions to increase patient therapy adherence and ultimately improve patient outcomes.

Strategic Pacts to Boost the SaaS Business: The company tends to opt for strategic buyouts to boost SaaS revenues. The Brightree ReSupply program continues to demonstrate synergies between the SaaS business and the core SRC business. The Home Medical Equipment (“HME”) SaaS business under the Brightree brand is growing at a very rapid pace.

MEDIFOX DAN is surpassing the company’s initial expectations with an accelerated contribution. Investing in the leading German healthcare is synonymous with ResMed’s vision of lower-cost, lower-acuity and highest-quality outcome care for patients. ResMed’s recent acquisition of Somnoware complements its current ecosystem of software solutions, including AirView for providers and physicians and Brightree for home care providers.

Downsides

Escalating Debt Level: The company’s high debt level remains a concern. As of Jun 30, 2023, the long-term debt was $1.43 billion, while the cash and cash equivalent balance was only $228 million. A higher debt level induces higher interest payments, which come along with the risk of failure to pay the same.

A Challenging Macroeconomic Scenario: Global macroeconomic conditions, including inflation, supply-chain disruptions and fluctuations in foreign currency exchange rates, and volatility in capital markets could continue to adversely affect RMD’s results of operations. A decline in the global economic environment may reduce the demand for the company’s products, resulting in lower sales, lower product prices and reduced reimbursement rates by third-party payers while increasing the cost of operating the business.

Apart from these impacts, ResMed’s gross margin in the fourth quarter of fiscal 2023 was further affected by the lower-than-expected product mix benefit.

Estimate Trend

The Zacks Consensus Estimate for RMD’s fiscal 2024 earnings per share (EPS) has moved down from $7.07 to $7.03 in the past 30 days.

The Zacks Consensus Estimate for the company’s fiscal 2024 revenues is pegged at $4.65 billion, up 10.04% from the year-ago reported figure.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Align Technology ALGN and Quanterix QTRX.

Haemonetics has an estimated earnings growth rate of 26.1% in fiscal 2024 compared with the industry’s 18.7%. HAE’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.39%. Its shares have rallied 16.2% against the industry’s 0.5% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology, carrying a Zacks Rank #2 at present, has a long-term estimated earnings growth rate of 17.5% compared with the industry’s 12.8%. Shares of the company have rallied 30.3% compared with the industry’s 13.9% growth over the past year.

ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed in one quarter. In the last reported quarter, it delivered an average earnings surprise of 9.9%.

Quanterix, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 62.8% for the current year compared with the industry’s 15.2%. Shares of QTRX have surged 154.9% against the industry’s 0.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report