Here's Why Molson Coors (TAP) is Marching Ahead of Its Industry

Molson Coors Beverage Company TAP has been benefiting from strength in core brands, as well as the above-premium portfolio and contributions from its Revitalization Plan. This led to robust first-quarter 2023 results, wherein the bottom and top lines surpassed the Zacks Consensus Estimate and improved year over year.

The company’s adjusted earnings of 54 cents per share surged 86.2% year over year. Net sales grew 5.9% to $2,346.3 million. On a constant-currency basis, net sales rose 8.2%, driven by favorable price and sales mix, offset by a slight decline in financial volume.

Net sales per hectoliter increased 6.1% on a reported basis and 8.4% on a constant-currency basis, driven by strong net pricing and a favorable sales mix stemming from premiumization.

Additionally, an uptrend in the Zacks Consensus Estimate echoes the same sentiment. Earnings estimates for GPS’s current financial year have increased 4.6% to $4.54 over the past 30 days.

Let’s Delve Deeper

Molson Coors is on track with its revitalization plan focused on achieving sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. The company intends to invest in iconic brands and growth opportunities in the above-premium beer space; expand in adjacencies and beyond beer; and create digital competencies for commercial functions, supply-chain-related system capabilities and employees.

To facilitate these investments, TAP plans to generate savings of $150 million by simplifying its structure. The company is also building on the strength of its iconic core brands. Additionally, its cost-saving program, announced in 2020, targets delivering cost savings of $600 million over three years.

Strength in Coors Light, Miller Lite and Coors Banquet resulted in total industry share growth in the United States, driven by brand positionings and better marketing. Molson Canadian and Carling beer in the U.K., and national champion brands witnessed significant market share gains.

The company remains committed to growing its market share through innovation and premiumization. With a view to accelerating portfolio premiumization, it has been aggressively growing its above-premium portfolio in the past few years. The company highlighted that it is making efforts to change the shape of its product portfolio and expand in growth areas.

Its U.S. above-premium portfolio witnessed sales that outpaced its U.S. economy portfolio, driven by rapid growth of its hard seltzers, the successful launch of Simply Spiked Lemonade, and the continued strength in Blue Moon and Peroni’s.

Driven by these factors, 2023 sales are projected to grow year over year in the low-single digits on a constant-currency basis, in line with our estimate of 1.5% growth. Underlying EBT is likely to grow year over year in the low-single digits on a constant-currency basis.

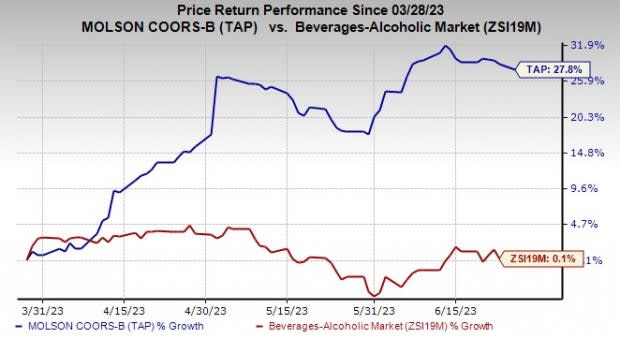

Consequently, shares of this Zacks Rank #2 (Buy) company have gained 27.8% in the past three months compared with the industry’s growth of 0.1%.

Image Source: Zacks Investment Research

However, Molson Coors’ worldwide first-quarter brand volumes fell 2.1% to 16.2 million due to sluggishness in America, as well as EMEA&APAC. Financial volumes declined 0.2% to 17 million hectoliters due to lower volumes in the Americas, partly offset by increased EMEA&APAC volumes.

Cost inflation related to materials, conversion and energy costs, and mix impacts of portfolio premiumization led to a rise in COGS per hectoliter of 22.7% on a reported basis and 7.4% in constant currency. Also, it has been witnessing weakened consumer demand across the beer industry due to pricing actions. Management expects global inflationary pressures to create a headwind.

Conclusion

We believe that brand strength, product innovation, pricing actions, the premiumization of its global portfolio, and the revitalization plan will offset cost woes and drive growth further for Molson Coors. Topping it, long-term growth of 4.3% and a Value Score of B raise optimism in the stock.

Other Stocks to Consider

We highlighted some other top-ranked stocks from the broader Consumer Staples space, namely Procter & Gamble PG, Nomad Foods NOMD and Celsius Holdings CELH.

Nomad Foods, currently sporting a Zacks Rank #1 (Strong Buy), manufactures and distributes frozen foods. NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current financial year sales suggests growth of 8% from the prior-year reported number, while earnings are likely to decline 3.4%.

Celsius Holdings currently flaunts a Zacks Rank #1. CELH specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements.

The Zacks Consensus Estimate for CELH’s current financial-year sales indicates 67.9% growth, and the same for EPS is expected to rise 154% from the year-ago reported figures. The company had an earnings surprise of 81.8% in the last reported quarter.

Procter & Gamble currently carries a Zacks Rank of 2. PG has a trailing four-quarter earnings surprise of 1.02%, on average. It has a long-term earnings growth rate of 6.1%.

The Zacks Consensus Estimate for Procter & Gamble’s current financial-year sales and EPS suggests growth of 1.3% and 0.9%, respectively, from the year-ago reported numbers. The consensus mark for PG’s EPS has moved up by a penny in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report