Here's Why You Must Add Masco (MAS) Stock to Your Portfolio

Masco Corporation MAS is benefiting from solid business growth initiatives, brand portfolio and accretive acquisitions.

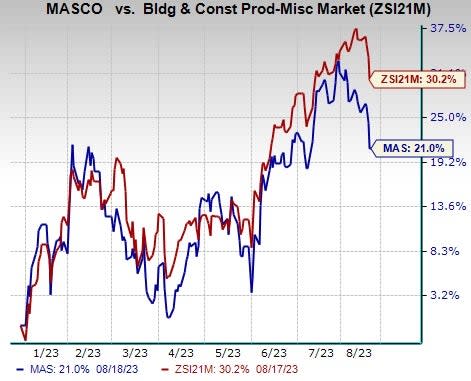

Shares of MAS have gained 21% in the year-to-date period, compared with the Zacks Building Products - Miscellaneous industry’s 30.2% growth. Although shares have underperformed its industry, the ongoing operational efficiencies and strong pricing strategies will drive the company’s growth in the upcoming period.

Notably, the Zacks Consensus Estimate for 2023 earnings has moved upward over the past 30 days to $3.60 per share from $3.35 per share. This depicts analysts’ optimism about the stock’s potential. The earnings of the company beat the consensus mark in 12 of the trailing 17 quarters.

Image Source: Zacks Investment Research

Let us delve deeper.

Factors Favoring Masco

Masco is gaining traction in its business by focusing on growth, productivity and shareholder returns. These factors are reflected in the company’s recently reported quarter. The company reported impressive second-quarter 2023 results, wherein earnings and net sales topped the Zacks Consensus Estimate by 24% and 1.5%, respectively. Also, the bottom line grew year over year by 3%. The growth was driven by higher net selling prices, improvement in operational efficiencies and lower transportation costs. Increase in net selling prices raised sales by 4% while focus on operational efficiencies expanded the quarter’s gross margin by 320 basis points to 36.2%.

Masco’s cost-saving initiatives, which include business consolidations, system implementations, plant closures, branch closures, improvement in the global supply chain and headcount reductions, bode well. These initiatives help the company expand its margins, as in the second quarter of 2023, and achieve company-wide annual savings goals.

Masco, notably, operates through two business segments, which are Plumbing products segment and Decorative Architectural products segment. Through the segments, the company operates through various divisions with a large number of products. Its popular brands include Behr paint, Delta and Hansgrohe faucets, bath and shower fixtures, Kichler decorative and outdoor lighting, and Hot Spring spas. Recently, Masco launched adjacent paint categories like aerosols, interior stains, and caulks and sealants within PRO, which added to the results in the first half of 2023 and are expected to continue to add benefits in 2023.

Furthermore, in the first six months of 2023, the company secured additional shelf space in adjacent product categories, launched new products and invested in the PRO paint business, portraying the strength of the Behr brand. The company plans to increase investment in people and capabilities in 2023.

Masco also focuses on expanding its portfolio through solid acquisition strategies. Accretive acquisitions enable the company to deliver a wide range of products and meet the growing customer demand. On Jul 21, 2023, the company entered into an agreement to acquire all of the share capital of Sauna360 Group Oy. The product portfolio of Sauna360 includes traditional, infrared, and wood-burning saunas along with steam showers. This acquisition is expected to be complete by the third quarter of 2023, and will be incorporated within the company’s Plumbing Products segment.

Zacks Rank

Masco currently sports a Zacks Rank #1 (Strong Buy).

Other Key Picks

Some other top-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, TopBuild Corp. BLD and Meritage Homes Corporation MTH.

EMCOR currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have risen 74.3% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share indicates growth of 11.5% and 35.9%, respectively, from the previous year’s reported levels.

TopBuild currently sports a Zacks Rank of 1. BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 43.2% in the past year.

The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share indicates growth of 3.4% and 4.6%, respectively, from the previous year’s reported levels.

Meritage Homes currently sports a Zacks Rank of 1. MTH delivered a trailing four-quarter earnings surprise of 24.1%, on average. Shares of the company have gained 61.6% in the past year.

The Zacks Consensus Estimate for MTH’s 2023 sales and earnings per share indicates decline of 7.9% and 35.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report