Here's Why Ollie's Bargain (OLLI) Warrants Your Attention

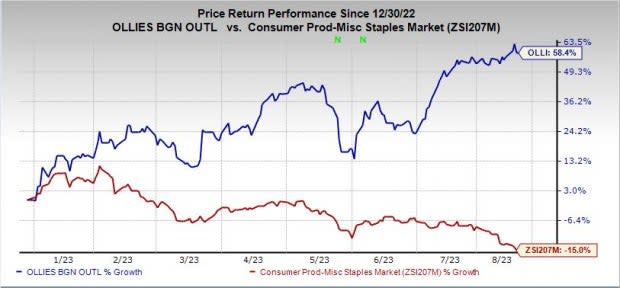

Ollie's Bargain Outlet Holdings, Inc. OLLI has defied market challenges, showcasing its resilience and growth potential. The company, based in Harrisburg, PA, has seen its stock rallying 58.3% year to date, in stark contrast to the industry's 15% decline.

The cornerstone of Ollie's success lies in its 'buy cheap, sell cheap' business model, coupled with prudent cost management and a focus on optimizing store efficiency. The expansion of its customer loyalty program, Ollie's Army, further bolsters its competitive edge.

Ollie's Bargain is poised for remarkable growth, with the Zacks Consensus Estimate projecting a robust 12.7% increase in current fiscal-year sales and an impressive 61.7% surge in earnings compared to the previous year. These figures underscore the company's inherent potential and optimistic outlook.

Capturing Market Opportunities

Ollie's Bargain’s focus on value-driven merchandise assortments positioned it well to capitalize on opportunities in the marketplace and effectively meet consumer demand. The continued success of Ollie's Army has played a vital role in driving sales. With a consistently growing membership, Ollie's Bargain ended the first quarter with more than 13.3 million active Ollie's Army members, which accounted for slightly more than 80% of sales.

Image Source: Zacks Investment Research

The company's performance has been bolstered by the favorable response to its deals and product offerings, which resonate with a wide customer base. Ollie's Bargain's ability to offer appealing and diverse products has been a key driver of its success. Additionally, the company's strong vendor relationships have played a crucial role in further cementing its position in the market.

Markedly, Ollie's Bargain's results depend on the availability of the brand name and closeout merchandise at compelling prices. Brand name and closeout merchandise represented about 65%, and non-closeout goods and private-label products collectively accounted for roughly 35% of fiscal 2022 merchandise purchases.

Undoubtedly, Ollie's Bargain remains committed to offering better deals, improving operating margins and increasing the store count. The company should benefit from a favorable closeout environment and trade-down activity.

Expansion Strategy

Ollie's Bargain is focused on expanding its store footprint as part of its growth strategy. The company aims to achieve a long-term goal of operating more than 1,050 stores, with a target of opening 50 to 55 stores annually. Ollie's Bargain has demonstrated strong growth in its store base, with a CAGR of 11.5% from 303 stores in fiscal 2018 to 468 stores in fiscal 2022.

Over the past years, Ollie's Bargain successfully opened 46 and 40 stores in fiscal 2021 and 2022, respectively. For the fiscal year 2023, the company plans to open 45 new stores while closing one location. In addition to new store openings, Ollie's Bargain is committed to remodeling existing stores, with plans to remodel 30 to 40 stores. The company continues to invest in its distribution network to ensure efficient operations.

Looking back at the company's track record, we noticed that net sales surged at a CAGR of 10.2% from $1.241 billion in fiscal 2018 to $1.827 billion in fiscal 2022.

Conclusion

Ollie's Bargain’s strategic endeavors position the stock firmly for growth. We believe that improved closeout opportunities, increased trade down from consumers and significant room for increasing the store count should support this Zacks Rank #2 (Buy) stock.

Management envisions fiscal 2023 net sales between $2.052 billion and $2.067 billion, suggesting an increase from $1.827 billion reported in fiscal 2022. Ollie’s Bargain anticipates comparable store sales to rise in the band of 2-2.8% against the comparable store sales decline of 3% reported last fiscal year. The company foresees fiscal 2023 adjusted earnings in the range of $2.56-$2.65 per share, up from the adjusted earnings of $1.62 reported last fiscal.

3 More Stocks Looking Hot

Here we have highlighted some other top-ranked stocks, namely Grocery Outlet GO, The TJX Companies TJX and Celsius Holdings CELH.

Grocery Outlet, the extreme value retailer of quality, name-brand consumables and fresh products, currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 12.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales and earnings suggests growth of 10.6% and 2.9%, respectively, from the year-ago reported numbers. GO has a trailing four-quarter earnings surprise of 14.3%, on average.

The TJX Companies, the leading off-price apparel and home fashions retailer, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 10.8%.

The Zacks Consensus Estimate for The TJX Companies’ current financial-year sales and earnings suggests growth of 6.5% and 15.4%, respectively, from the year-ago reported numbers. TJX has a trailing four-quarter earnings surprise of 6.6%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 87.6% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report