Here's Why One Should Avoid Air Transport (ATSG) Stock Now

Air Transport Services ATSG is currently mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Let’s delve deeper.

Southward Earnings Estimate Revisions: The Zacks Consensus Estimate for the company’s current-quarter earnings has been revised 40.8% downward over the past 60 days. For 2023, the consensus mark for earnings has moved 18.4% south in the same time frame. The consensus mark has moved 18.5% downwards for 2024. The unfavorable estimate revisions indicate brokers’ lack of confidence in the stock.

Weak Zacks Rank and Style Score: Air Transport Servicescurrently carries a Zacks Rank #5 (Strong Sell). Moreover, the company’s current Growth Style Score of C shows its unattractiveness.

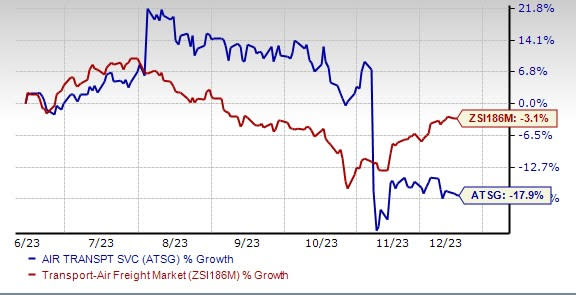

Unimpressive Price Performance: ATSG has declined 17.9% over the past six months against its industry’s 3.1% contraction.

Image Source: Zacks Investment Research

Other Headwinds: Air Transport Services is suffering from weak demand for cargo aircraft. Owing to the soft demand scenario, management trimmed its 2023 earnings per share guidance. The projection for 2024 capital expenditure has also been slashed due to the airfreight demand softness.

The conflict in Israel is also expected to hurt its performance. High operating expenses represent another headwind. ATSG's liquidity position is concerning as well.

Bearish Industry Rank: The industry to which ATSG belongs currently has a Zacks Industry Rank of 219 (of 250 plus groups). Such an unfavorable rank places the industry in the bottom 13% of the Zacks industries. Studies show that 50% of a stock price movement is directly related to the performance of the industry group it belongs to.

A mediocre stock within a strong group is likely to outclass a robust stock in a weak industry. Therefore, reckoning the industry’s performance becomes imperative.

Stocks to Consider

Investors interested in the broader Transportation sector may consider some better-ranked stocks like Air Canada ACDVF and SkyWest SKYW.

Air Canada currently sports a Zacks Rank #1 (Strong Buy). An uptick in passenger traffic is aiding ACDVF. Recently, management announced plans to launch a year-round route between Montreal and Madrid. You can see the complete list of today’s Zacks #1 Rank stocks here.

The service will commence in May of the following year as part of its expanded international summer 2024 flying schedule to cater to increased demand. The Zacks Consensus Estimate for 2023 and 2024 earnings has witnessed increases of 32.6% and 41.3% in the past 60 days, respectively.

SkyWest currently carries a Zacks Rank #2 (Buy). SKYW's fleet modernization efforts are commendable. The company’s initiatives to reward its shareholders also bode well.

The Zacks Consensus Estimate for SKYW’s current-year earnings has risen 38.9% in the past 60 days. The Zacks Consensus Estimate for next-year earnings has jumped 33.2% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Air Canada (ACDVF) : Free Stock Analysis Report