Here's Why Paragon Care (ASX:PGC) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Paragon Care (ASX:PGC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Paragon Care

Paragon Care's Improving Profits

Paragon Care has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Paragon Care's EPS shot up from AU$0.015 to AU$0.019; a result that's bound to keep shareholders happy. That's a commendable gain of 33%.

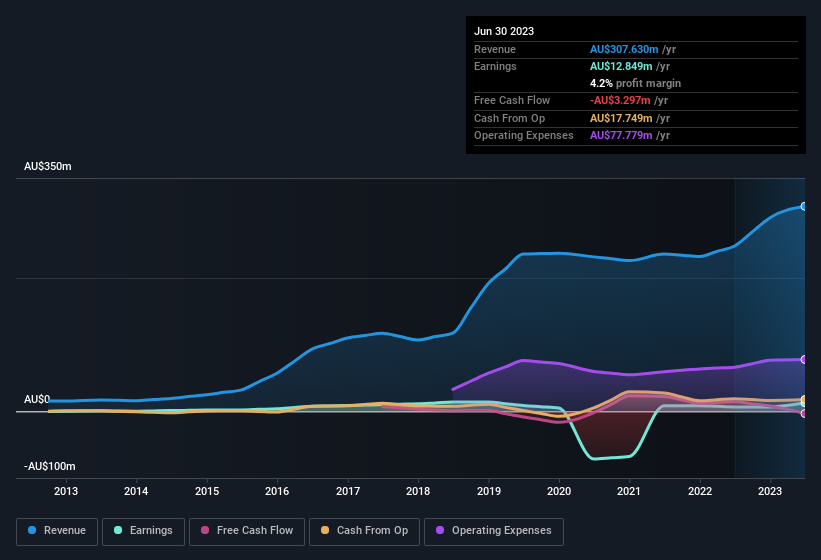

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Paragon Care maintained stable EBIT margins over the last year, all while growing revenue 24% to AU$308m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Paragon Care is no giant, with a market capitalisation of AU$125m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Paragon Care Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Paragon Care shareholders can gain quiet confidence from the fact that insiders shelled out AU$707k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Group CEO, Mark Hooper, who made the biggest single acquisition, paying AU$325k for shares at about AU$0.32 each.

On top of the insider buying, it's good to see that Paragon Care insiders have a valuable investment in the business. As a matter of fact, their holding is valued at AU$39m. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 31% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Paragon Care Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Paragon Care's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Even so, be aware that Paragon Care is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

The good news is that Paragon Care is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.