Here's Why Ralph Lauren (RL) Stock is Poised for Growth in 2024

Ralph Lauren Corporation RL seems to be doing well on the bourses, thanks to its digital endeavors and other robust strategies. Undoubtedly, management is focused on enhancing digital capabilities, deepening relations with customers via marketing, expanding international markets and efficiently controlling expenses.

Its Next Great Chapter plan appears encouraging. As part of the plan, it completed the transition of Chaps to a licensed business, thus concluding its portfolio realignment announced last year. The move will likely enable it to focus on core brands, as part of the Next Great Chapter elevation strategy. In addition, the company’s strategy of product elevation, personalized and targeted promotion, disciplined inventory management and favorable channel and geographic mix, bodes well.

Ralph Lauren is making significant progress in expanding digital and omnichannel capabilities through investments in mobile, omnichannel and fulfillment. The company remains focused on further digital investments to continue the creation of content for all platforms, expanding digital capabilities to improve the user experience and continuing to leverage AI and data to serve consumers more efficiently.

The company continues to scale and expand its connected retail capabilities, including virtual selling appointments, “buy online, pick up in store”, endless aisle product availability and more. It launched its first-ever full catalog Ralph Lauren mobile app, thus efficiently leveraging its connected retail capabilities to deliver the most personalized and content-rich platform.

What’s More?

Ralph Lauren is on track to exceed its top and bottom-line targets under the “Next Great Chapter” plan that was announced in June 2018. Later, it announced measures to accelerate its “Next Great Chapter plan”, which includes creating a simplified global organizational structure and rolling out improved technological capabilities.

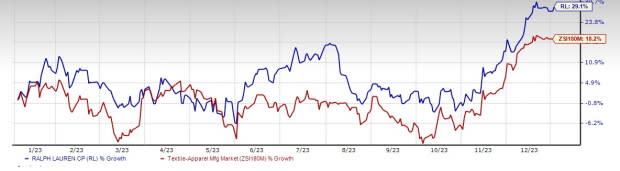

Image Source: Zacks Investment Research

Analysts seem quite optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) is currently pegged at $6.5 billion and $9.43, respectively. These estimates show corresponding growth of 1.4% and 13.1% year over year. To wrap up, this Zacks Rank #3 (Hold) company seems to be a decent investment pick given all the aforementioned positives.

Buoyed by such strengths, shares of this apparel and accessories designer have increased 29.1% compared with the industry’s 18.2% growth in a year. A Value Score of B further adds strength to the company.

Eye These Solid Picks

Some better-ranked companies are GIII Apparel GIII, lululemon athletica LULU and Royal Caribbean RCL.

GIII Apparel, an accessories dealer, sports a Zacks Rank #1 (Strong Buy), at present. GIII has a trailing four-quarter earnings surprise of 541.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year EPS suggests growth of 39.3%, respectively, from the year-ago corresponding figure.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.2% and 23.2%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Royal Caribbean carries a Zacks Rank of 2 at present. RCL has a trailing four-quarter earnings surprise of 28.3%, on average.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates increases of 57.7% and 187.9%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report