Here's Why You Should Retain Accuray (ARAY) Stock for Now

Accuray Incorporated ARAY is well-poised for growth in the coming quarters, courtesy of continued solid demand for its products. The optimism led by the first-quarter fiscal 2024 performance and potential in Precision Treatment Planning System (TPS) are expected to contribute further. However, overdependence on technologies and macroeconomic instability persist.

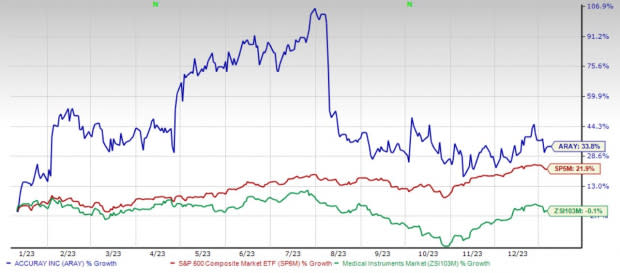

Over the past year, this Zacks Rank #3 (Hold) stock has gained 33.8% against the 0.1% decline of the industry. The S&P 500 has witnessed 21.9% growth in the said time frame.

The renowned radiation oncology company has a market capitalization of $268.9 million. Accuray projects 70% growth for fiscal 2024, in which it expects to maintain its strong performance. The company’s P/S ratio of 0.6 is favorable to the industry’s 3.3.

Image Source: Zacks Investment Research

Let’s delve deeper.

Solid Product Demand: We are upbeat about Accuray’s products, which have been registering robust customer adoption over the past few months. On the first quarter of fiscal 2024 earnings call in November 2023, management confirmed that the company witnessed continued customer adoption of CyberKnife, Radixact and TomoTherapy platforms. The company also expanded its installed base of customers within the quarter to 1,040 systems, representing 5% year-over-year growth.

In October, Accuray also unveiled its latest introduction for the Radixact, the CENOS online adaptive capability.

Potential in Precision TPS: We are optimistic about the Accuray Precision TPS, which offers an efficient way for clinicians to create high-quality radiation therapy treatment plans for various cases. It includes features such as multi-modality image fusion with a unique deformable image registration algorithm, a comprehensive set of contouring tools, and options for AutoSegmentation auto contouring for specific body areas.

Strong Q1 Results: Accuray’s first-quarter fiscal 2024 performance raises our optimism. It witnessed solid overall top-line results and robust Product revenues. Geographically, Accuray’s performance was strong in EIMEA (Europe, India, the Middle East and Africa), China and Japan. The gross margin expansion also bodes well.

Downsides

Macroeconomic Instability: Accuray’s business is materially affected by global market conditions and the overall economy. Concerns over economic and political stability have contributed to increased volatility and diminished expectations for the economy and the markets. Further, the U.S. federal government has called for or enacted substantial changes to healthcare and tax policies, which may include changes to existing trade agreements and may have a significant impact on the company’s operations.

Overdependence on Technologies: Achieving consumer and third-party payor acceptance of the CyberKnife and TomoTherapy platforms as preferred methods of tumor treatment is crucial to Accuray’s continued success. The possibility of Accuray’s products not gaining significant market acceptance among consumers and healthcare payors despite substantial time and expenses being spent on their education can weigh on the company’s performance.

Estimate Trend

Accuray has been witnessing a negative estimate revision trend for fiscal 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings has moved from break-even earnings per share to a loss of 3 cents per share.

The Zacks Consensus Estimate for second-quarter fiscal 2024 revenues is pegged at $107.1 million, suggesting a 6.7% decline from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Merit Medical Systems, Inc. MMSI and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 36.3% compared with the industry’s 10.3% rise in the past year.

Merit Medical, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 11.5%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, with the average being 14.4%.

Merit Medical has gained 8.4% compared with the industry’s 10.8% rise in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 40.1% against the industry’s 0.1% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report