Here's Why You Should Retain Align Technology (ALGN) Stock Now

Align Technologies ALGN is well-poised for growth in the coming quarters, backed by its global expansion to address the vast untapped demand in the malocclusion space. The company launched its first subscription-based clear aligner program DSP worldwide, which looks encouraging.

Mounting expenses are putting pressure on margins. Strong FX headwind impedes growth.

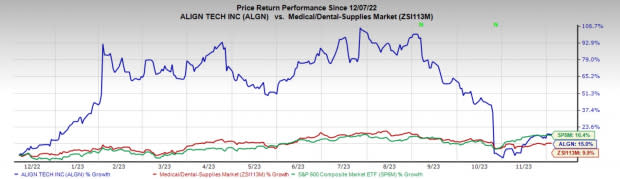

In the past year, this Zacks Rank #3 (Hold) stock has increased 15% compared with the 9.9% rise of the industry and 16.4% growth of the S&P 500 composite.

The renowned medical device company has a market capitalization of $16.83 billion. ALGN projects a long-term estimated earnings growth rate of 17.5% compared with 12.5% of the industry.

Let’s delve deeper.

Upsides

Invisalign Portfolio Expansion: Align Technology’s Invisalign portfolio offers orthodontic treatment to straighten teeth without metal braces.

In the third quarter of 2023, the company continued to roll out the Invisalign Comprehensive Three and Three product in APAC, where it is available in China, Hong Kong, Korea, Taiwan and India. Instead of unlimited additional aligners within five years of the treatment end date, the latest configuration offers Invisalign comprehensive treatment with three other aligners included within three years of the treatment end date.

Geographic Expansion Continues: Align Technology is expanding its sales and marketing by reaching new countries and regions, including new areas within Africa and Latin America. The company also performs digital treatment planning and interpretation for restorative cases worldwide, including Costa Rica, China, Germany, Spain, Poland and Japan, among others. Align Technology continues to expand its business in 2023 through investments in resources, infrastructure and initiatives that drive growth in Invisalign treatment, intraoral scanners and Exocad CAD/CAM software in existing and new international markets.

Strategic Alliances: Align Technology's slew of strategic alliances looks impressive. The company has well-established relationships with many DSOs, especially in the United States, and is consistently exploring collaboration with others that drive the adoption of digital dentistry.

Image Source: Zacks Investment Research

In the Americas, Align Technology is focused on reaching young adults as well as teens and their parents through influencer and creator-centric campaigns in 2023. It is partnering with leading smile squad creators, including Marshall Martin, Rally Shaw and Jeremy Lin. Each of these creators shared their personal experiences with Invisalign treatment and why they chose to transform their smile with Invisalign aligners.

Downsides

Currency Headwinds: Foreign exchange is a major headwind for Align Technology due to a considerable percentage of its revenues coming from outside the United States (in 2022, 44% of the company’s consolidated revenues came from international regions). Through the first nine months of 2023, the strengthening of the U.S. dollar against nearly every other major currency hampered Align Technology’s revenues in the international markets. This was mainly due to the Fed’s 10 consecutive aggressive hikes in interest rates to tackle inflation since March 2022.

Competitive Landscape: Align Technology faces significant competition from traditional orthodontic appliance (or wires and brackets) players such as 3M’s Unitek, Danaher Corporation’s Sybron Dental Specialties and Dentsply International. The company also competes with products similar to Invisalign Technology, such as the ones from Ormco Orthodontics, a division of Sybron Dental Specialties.

Estimate Trend

The Zacks Consensus Estimate for Align Technologies’ 2023 earnings per share (EPS) has dropped from $8.77 to $8.42 in the past 90 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at 3.86 billion. The projection suggests a 3.3% rise from the year-ago reported number.

Other Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2 (Buy), Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. The company's shares have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 EPS have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report