Here's Why You Should Retain Catalent (CTLT) Stock for Now

Catalent, Inc. CTLT is well-poised for growth in the coming quarters, courtesy of strength in its products and services portfolio. The optimism led by its preliminary first-quarter fiscal 2024 performance, along with its technology foundation, is expected to contribute further. Catalent’s operation in a competitive landscape and customer dependency pose threats.

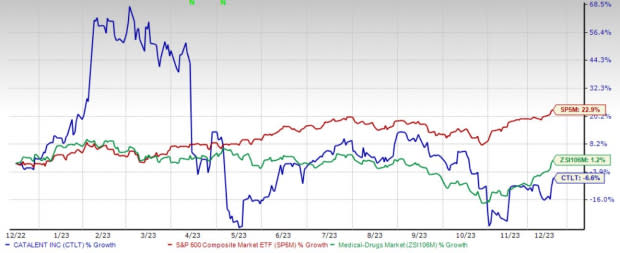

Over the past year, this Zacks Rank #3 (Hold) stock has lost 6.6% against 1.2% growth of the industry and 22.9% rise of the S&P 500.

The renowned global developer and supplier of better treatments has a market capitalization of $7.47 billion. Catalent projects 27.8% growth for the next five years and expects to maintain its strong performance. CTLT’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed in the other two, the average earnings surprise being 9.2%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Products and Services: We are upbeat about Catalent’s product and service launches over the past few months. On the preliminary first-quarter fiscal 2024 earnings call, Catalent’s management stated that its non-COVID non-Sarepta Biologics business is expected to grow in the low- to mid-teens in fiscal 2024 as the company launches GLP-1 production and bring on incremental capacity and improve productivity.

In June, the company announced that it had expanded its integrated development, manufacturing and supply solution, OneBio Suite, across a range of biologic modalities, including antibody and recombinant proteins, cell and gene therapies and mRNA.

Technology Foundation: Catalent is equipped with broad and diverse technology platforms that are supported by extensive know-how and nearly 1,300 patents and patent applications worldwide across advanced delivery technologies, drug and biologics formulation, and manufacturing, buoying our optimism. Its leading softgel platforms and modified release technologies provide formulation expertise to solve complex delivery challenges for its customers. Catalent offers advanced technologies for the delivery of small molecules and biologics via respiratory, ophthalmic and injectable routes, including the blow-fill-seal unit dose technology and prefilled syringes.

Strong Q1 Results: Catalent’s preliminary first-quarter fiscal 2024 results buoy optimism. The company registered a year-over-year improvement in the Pharma and Consumer Health segment and the Biologics segment’s non-COVID revenues. Management’s confirmation regarding Catalent’s strength in its non-COVID Biologics portfolio and continued progress in improving its operational performance raise our optimism.

Downsides

Customer Dependency: Catalent’s customers are engaged in the research, development, production and marketing of pharmaceutical, biotechnology and consumer health products. The amount of customer spending on these activities and the outcomes of such activities have a large impact on Catalent’s sales and profitability. Available resources, the need to develop new products and consolidation in the industries in which its customers operate may have an impact on such spending.

Stiff Competition: Catalent operates in a highly competitive market, wherein it competes with multiple companies, including those offering advanced delivery technologies and outsourced dose form or biologics manufacturing. The company also competes in some cases with the internal operations of pharmaceutical, biotechnology and consumer health customers with manufacturing capabilities and chooses to source these services internally.

Estimate Trend

Catalent has been witnessing a negative estimate revision trend for fiscal 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 10.9% south to 73 cents.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2024 revenues is pegged at $1.01 billion, suggesting an 11.7% decline from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 48% compared with the industry’s 10.1% rise in the past year.

DexCom, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, with an average of 36.4%.

DexCom’s shares have gained 7.4% compared with the industry’s 2.8% rise in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 54.4% compared with the industry’s 2.8% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report