Here's Why You Should Retain SITE Centers (SITC) Stock Now

SITE Centers Corp’s SITC well-located portfolio of retail real estate assets concentrated in the suburban and high household income regions of the Southeast, with maximum concentrations in Florida, Georgia and North Carolina positions it well for growth. Its focus on essential retail businesses and an aggressive capital-recycling program are likely to aid the company’s performance in the upcoming period. However, rising e-commerce adoption and a high interest rate environment pose concerns for it.

What’s Aiding it?

SITE Centers’ properties are located in some of the affluent markets of the Southeast region where the average household income is around $112,000. This enables it to enjoy solid trade area demographics, boosting demand for its properties. Further, the continuation of work from home has driven demand for its properties in the suburbs.

The company has a solid tenant roster, including several industry bellwethers, all of which hold a relatively strong financial position and have performed well over time. As of Jun 30, 2023, 88% of its tenants were national, per its annualized base rent. This assures stable rental revenues for the company. For 2023, while we expect rental income to exhibit marginal year-over-year growth, the metric is projected to increase 2.9% in 2024 and 3.8% in 2025.

Having a necessity-business component has been the saving grace of retail REITs amid pandemic-related headwinds. The majority of SITE Centers’ tenants at its shopping centers cater to day-to-day consumer needs, with a focus on value and convenience retailers. Significant essential retail businesses at the company’s centers add resiliency to its business and enable it to generate stable revenues during an adverse economic environment.

This retail real estate investment trust’s (REIT) aggressive capital-recycling program highlights its prudent capital-management practices and helps preserve balance sheet strength. Through this, it has divested its slow-growth assets and redeployed proceeds to acquire premium U.S. shopping centers, thereby enhancing its cash-flow growth and overall portfolio quality.

Notably, in the second quarter of 2023, the company disposed of two joint-venture assets for $72 million ($14 million at the company’s share). It also acquired three convenience properties worth $49 million during the same period.

On the balance sheet front, SITE Centers had $28 million of cash and equivalents and $775 million of availability on lines of credit as of Jun 30, 2023. It also enjoys credit ratings of BBB-/Baa3/BBB, with a stable outlook from S&P/ Moody's/ Fitch, respectively, rendering it access to the debt market at favorable costs. Hence with ample financial flexibility and manageable near-term debt maturities, SITC seems well-positioned to capitalize on long-term growth opportunities.

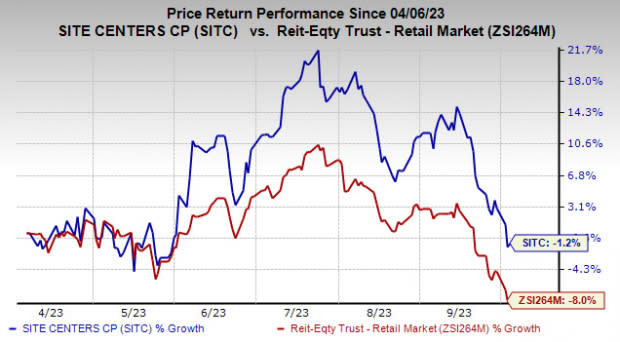

Over the past six months, shares of this Zacks Rank #3 (Hold) company have declined 1.2% compared with the industry’s fall of 8%.

Image Source: Zacks Investment Research

What’s Hurting it?

Given the convenience of online shopping, higher e-commerce adoption is concerning for SITE Centers. Online retailing will likely remain a popular choice among customers, thus adversely impacting the market share for brick-and-mortar stores.

Limited consumer willingness to spend amid persistent macroeconomic uncertainty and a high interest rate environment is likely to hurt demand for retail space, weighing on SITC. Also, potential tenant bankruptcies for some of the company’s national tenants could adversely impact its top-line growth tempo in the upcoming period.

Further, given the prevailing high interest rates, SITC may find it difficult to purchase or develop real estate with borrowed funds as the costs are likely to be on the higher side. Its total consolidated debt as of Jun 30, 2023, was $1.80 billion. The dividend payout might also seem less attractive than the yields on fixed-income and money market accounts due to high interest rates.

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Brixmor Property Group BRX and Phillips Edison & Company PECO, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brixmor’s current-year FFO per share has moved nearly 1% northward over the past two months to $2.03.

The Zacks Consensus Estimate for Phillips Edison’s ongoing year’s FFO per share has been raised marginally upward over the past week to $2.33.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brixmor Property Group Inc. (BRX) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

Phillips Edison & Company, Inc. (PECO) : Free Stock Analysis Report