Here's Why You Should Retain Charles River (CRL) Stock Now

Charles River Laboratories International, Inc. CRL is likely to grow in the coming quarters, backed by the strong prospects of the RMS (Research Models and Services) segment. Presently, the company is the largest provider of outsourced drug discovery, non-clinical development and regulated safety testing services worldwide. Stable solvency is an added upside.

However, headwinds related to foreign exchange fluctuations and competitive pressure remain concerning for CRL’s operations.

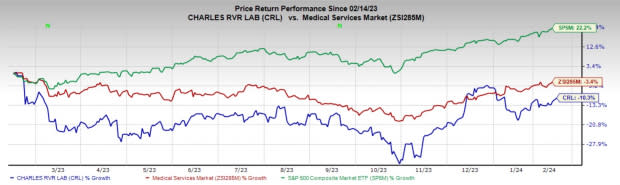

In the past year, this Zacks Rank #3 (Hold) stock has declined 10.3% compared with the 3.4% fall of the industry and a 22.2% rise of the S&P 500 composite.

Operating as a full-service, early-stage contract research organization, Charles River has a market capitalization of $11.39 billion. The company has an earnings yield of 4.92% compared with the industry’s 1.85%. CRL surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 8.43%.

Let’s delve deeper.

Upsides

RMS Business Rebounds: RMS business services are in high demand among Charles River’s clients in the field of basic research and screening of non-clinical drugs. The segment continues to benefit from broad-based growth in all geographic regions for small research models.

Of late, the company witnessed strong growth within the insourcing solutions business led by the CRADL (Charles River Accelerator and Development Labs) initiative. In the third quarter of 2023, the CRADL sites, or the flexible vivarium rental space, overall remained well-utilized and continued to generate significant revenue growth compared to the year-ago period.

Image Source: Zacks Investment Research

Global biopharmaceutical companies, small and midsized biotechs and academic as well as government accounts continue to make significant contributions to the growth rate. The company is now focused on ramping up the utilization of the new sites and continuing to moderately add new sites that will generate a runway for continued robust revenue growth and margin enhancement opportunities for CRADL.

DSA Arm Continues to Thrive: CRL is gaining from its extensive expertise in the discovery of preclinical candidates and the design, execution and reporting of safety assessment studies for numerous types of compounds, including cell and gene therapies and small and large molecule pharmaceuticals. The demand for these services is driven by the needs of large global pharmaceutical companies that continue to transition to an outsourced drug development model in addition to mid-size and emerging biotechnology companies, industrial and agrochemical companies and non-governmental organizations that rely on outsourcing.

In the third quarter, organic revenue growth was mainly driven by broad-based growth in the Safety Assessment business on contributions from base pricing and study volume. The DSA backlog decreased to $2.6 billion in the third quarter from $2.8 billion at the end of the second quarter.

Stable Solvency Structure: Charles River exited the third quarter of 2023 with cash and cash equivalents of $157 million, while short-term payable debt remained nil compared with $200 million at the end of the second quarter. Meanwhile, the total debt was $2.51 billion compared with $2.68 billion at the end of the second quarter.

The company reported a total debt-to-capital of 43.2% at the end of the third quarter, a marginal drop from 45.1% at the end of the second quarter.

Downsides

Foreign Exchange Translation Impacts Sales: Foreign exchange is a major headwind for Charles River as a considerable percentage of its revenues comes from outside the United States. The strengthening of the Euro and some other developed market currencies has been constantly hampering the company’s performance in international markets.

Competitive Landscape: Charles River competes in the marketplace based on its therapeutic and scientific expertise in early-stage drug research, quality, reputation, flexibility, responsiveness, pricing, innovation and global capabilities. The company primarily faces a broad range of competitors of different sizes and capabilities in each of its three business segments. This fiercely competitive global market impacts CRL’s market capitalization scenario.

Estimate Trend

The Zacks Consensus Estimate for Charles River’s 2023 earnings has remained constant at $10.58 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $4.10 billion, suggesting a 3.2% increase from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA.

Cardinal Health has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8%. CAH’s earnings surpassed the estimates in each of the trailing four quarters, the average surprise being 15.6%. Its shares have increased 31.5% compared with the industry’s 11.1% rise in the past year.

CAH carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker, carrying a Zacks Rank #2 at present, has an earnings yield of 3.46% against the industry’s -0.75%. Shares of the company have increased 28.8% compared with the industry’s 4% rise over the past year.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.09%. In the last reported quarter, it delivered an average earnings surprise of 5.81%.

DaVita, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 17.3% compared with the industry’s 11.9%. Shares of DVA have rallied 37.9% compared with the industry’s 8.4% rise over the past year.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.6%. In the last reported quarter, it delivered an average earnings surprise of 48.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report