Here's Why You Should Retain CONMED (CNMD) Stock for Now

CONMED Corporation (CNMD) is well poised for growth in the coming quarters, courtesy of its broad product spectrum. The optimism, led by the solid third-quarter 2023 performance and a potential General Surgery, is expected to contribute further. However, headwinds from supply-chain constraints and data security threats persist.

This currently Zacks Rank #3 (Hold) company’s shares have risen 29.6% year to date compared with the industry’s 10.7% growth. The S&P 500 Index has increased 23.1% during the same time frame.

CONMED, the renowned global medical products manufacturer specializing in surgical instruments and devices, has a market capitalization of $3.42 billion. The company projects 28.5% growth over the next five years and expects to maintain its strong performance going forward.

Image Source: Zacks Investment Research

Its earnings surpassed estimates in three of the trailing four quarters and missed the same once, delivering a negative average surprise of 7.84%.

Let’s delve deeper.

Potential in General Surgery: The segment consists of a complete line of endo-mechanical instrumentation for minimally invasive laparoscopic and gastrointestinal procedures, a line of cardiac monitoring products, as well as electrosurgical generators and related instruments.

CONMED’s unique products and solutions within the General Surgery segment have been providing a competitive edge in the MedTech space. One of these products, the Anchor Tissue Retrieval bag, deserves a special mention. It is one of the major platforms in the company’s specimen bag portfolio.

Broad Product Spectrum: CONMED offers a broad line of surgical products, including several new devices in the Orthopedic, Laparoscopic, Robotic, Open Surgery, Gastroenterology, Pulmonary and Cardiology sections.

Products like the Hi-Fi Tape and Hi-Fi suture interface are critical components of repair security in the rotator cuff repair space. During the third quarter, CNMD remained focused on the introduction of a delivery system for MIS rotator cuff repair.

Other notable offerings are the MicroFree platform in Orthopedics, the TruShot, the Y-Knot Pro and the CRYSTALVIEW Pump. The Anchor Tissue Retrieval bag is a unique product under the General Surgery arm.

Solid Recurring Revenue Base: Approximately 80% of CONMED’s revenues are recurring, derived from the sale of disposable single-use products. The remaining 20% comes from sales of capital equipment (such as powered drills and saws for surgery, electrosurgical generators, video-imaging cameras, fluid control systems and surgical hand-pieces). This, in turn, creates demand for complementary single-use items.

Hospitals and clinics are expanding the use of single-use, disposable products. This endeavor is aimed at reducing expenses related to sterilizing surgical instruments and products following surgery.

CONMED’s revenues totaled $304.6 million in third-quarter 2023, up 10.7% year over year. Additional sales from newly acquired businesses contributed approximately 40 basis points of growth.

Downsides

Regulatory Requirements: Substantially, all CONMED products are classified as class II medical devices, subject to regulations from numerous agencies and legislative bodies worldwide. As a manufacturer of medical devices, the company’s manufacturing processes and facilities are subject to on-site inspection and constant review by the FDA for compliance with the Quality System Regulations.

Supply Constraints and FX Impact: Although CONMED recorded strong growth across all segments in the third quarter, the legacy orthopedic business was hurt by supply-chain constraints. The supply disruption continues to pose a headwind for the company during the fourth quarter of 2023.

CNMD expects supply-chain issues to improve from the first quarter of 2024. Moreover, revenues were hurt by unfavorable currency movement during the third quarter. The company continues to expect foreign exchange to have an unfavorable impact on its top-line growth by 150-200 basis points in 2023. Currency rates are expected to negatively impact earnings by 20-25 cents per share.

Estimate Trend

CONMED is witnessing a positive estimate revision trend for 2023. In the past 60 days, the Zacks Consensus Estimate for earnings has improved from $3.47 per share to $3.50.

The same for the company’s fourth-quarter revenues is pegged at $332.94 million, indicating a 32.7% improvement from the year-ago quarter’s reported number. The bottom-line estimate for the fourth quarter is expected to improve 164.3% from the year-ago period’s level of $1.11.

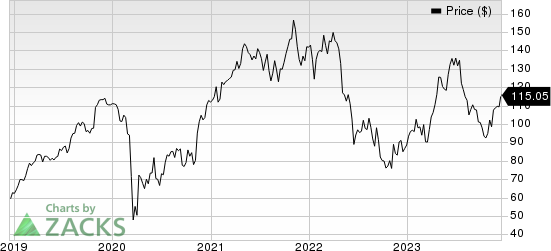

CONMED Corporation Price

CONMED Corporation price | CONMED Corporation Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DexCom DXCM, HealthEquity, Inc. HQY and Biodesix BDSX.

DexCom, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 33.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.43%. The company’s shares have risen 4.2% year to date compared with the industry’s 3.8% growth.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 26.8%. HQY’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 16.5%.

The company’s shares have rallied 15% year to date against the industry’s 9.9% decline.

Biodesix, carrying a Zacks Rank #2 at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

The stock has fallen 30.9% year to date compared with the industry’s 9.9% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report