Here's Why You Should Retain CONMED (CNMD) Stock for Now

CONMED Corporation CNMD is well poised for growth in the coming quarters, courtesy of its broad product spectrum. The optimism, led by the solid fourth-quarter 2022 performance and a potential General Surgery, is expected to contribute further. Headwinds from regulatory requirements and data security threats persist.

So far this year, this Zacks Rank #3 (Hold) stock has gained 15.7% compared with the industry’s 5.3% growth and the S&P 500’s 7.5% rise.

CONMED, the renowned global medical products manufacturer specializing in surgical instruments and devices, has a market capitalization of $3.17 billion. The company projects 18% growth for the next five years and expects to maintain its strong performance. Its earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the negative average surprise being 9.82%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Potential in General Surgery: General Surgery consists of a complete line of endo-mechanical instrumentation for minimally invasive laparoscopic and gastrointestinal procedures, a line of cardiac monitoring products as well as electrosurgical generators and related instruments.

CONMED’s unique products and solutions within the General Surgery segment have been providing a competitive edge in the MedTech space. One of the most unique products under General Surgery, the Anchor Tissue Retrieval bag, deserves a mention. It is one of the major platforms in CONMED’s specimen bag portfolio.

Broad Product Spectrum: CONMED offers a broad line of surgical products, which includes several new devices in the Orthopedic, Laparoscopic, Robotic, Open Surgery, Gastroenterology, Pulmonary and Cardiology sections. Products like Hi-Fi Tape and Hi-Fi suture interface are a critical component of repair security in the rotator cuff repair space.

Other notable offerings include the MicroFree platform in Orthopedics, the TruShot, the Y-Knot Pro and the CRYSTALVIEW Pump. The Anchor Tissue Retrieval bag is a unique product under the General Surgery arm.

Solid Recurring Revenue Base: Approximately 80% of CONMED’s revenues are recurring, derived from the sale of disposable single-use products. Hospitals and clinics are expanding the use of single-use, disposable products. This endeavor is aimed at reducing expenses related to sterilizing surgical instruments and products following surgery.

Using one-time disposable products also lowers the risk of patient infection and reduces the cost of post-operative care, which is no longer covered by Medicare. The remaining 20% of revenues comes from sales of capital equipment (such as powered drills and saws for surgery, electrosurgical generators, video-imaging cameras, fluid control systems and surgical hand-pieces), which, in turn, creates demand for complementary single-use items.

Downsides

Regulatory Requirements: Substantially all CONMED products are classified as class II medical devices, subject to regulations of numerous agencies and legislative bodies worldwide. As a manufacturer of medical devices, the company’s manufacturing processes and facilities are subject to on-site inspection and constant review by the FDA for compliance with the Quality System Regulations.

Dismal Q4 Results: CONMED’s dismal fourth-quarter 2022 results raise concerns. The company witnessed decline in segmental performances across its Orthopedic Surgery and General Surgery units. It also saw sales decline in domestic and overseas markets. The contraction in gross margin does not bode well for the stock.

Estimate Trend

CONMED is witnessing a flat estimate revision trend for 2023. In the past 60 days, the Zacks Consensus Estimate for its earnings have remained flat at $3.31 per share.

The Zacks Consensus Estimate for the company’s first-quarter 2023 revenues is pegged at $267.3 million, which suggests a 10.3% improvement from the year-ago quarter’s reported number.

Our first-quarter revenue estimate is $266.5 million, indicating a 10% improvement from the year-ago quarter’s reported number.

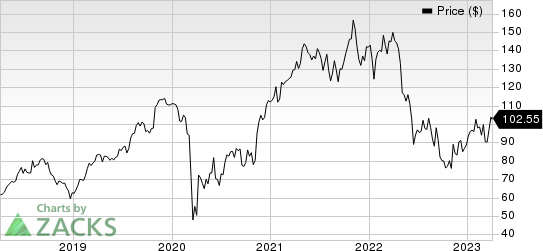

CONMED Corporation Price

CONMED Corporation price | CONMED Corporation Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space areBecton, Dickinson and Company BDX, Henry Schein HSIC and The Cooper Companies COO.

Becton, Dickinson and Company, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth of 7.8%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 6.47%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

So far this year, BDX’s shares have lost 2.9% compared with the industry’s 5.6% growth.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth of 18.3%. Its earnings surpassed estimates in three of the trailing four quarters and met the same once, the average beat being 2.97%.

So far this year, the company’s shares have gained 2.4% compared with the industry’s 5.6% growth.

The Cooper Companies, carrying a Zacks Rank #2 at present, has an estimated long-term growth of 11%. COO’s earnings missed estimates in each of the trailing four quarters, the average negative surprise being 1.82%.

So far this year, the company’s shares have gained 11.4% compared with the industry’s 5.2% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report