Here's Why You Should Retain Edward Lifesciences (EW) Stock Now

Edwards Lifesciences Corporation EW is well-poised for growth in the coming quarters, backed by the strength of the Surgical Structural Heart portfolio. In the third quarter of 2023, the company achieved several important milestones in TMTT (Transcatheter Mitral and Tricuspid Therapies), advancing toward the vision to build a portfolio of therapies to transform the lives of mitral and tricuspid patients. Favorable solvency also bodes well for the stock.

Meanwhile, mounting expenses and competitive pressures from other players in the industry remain a concern.

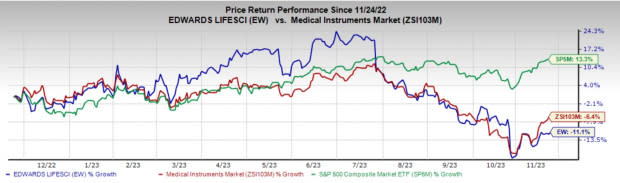

In the past year, this Zacks Rank #3 (Hold) stock has decreased 11.1% compared with the 6.4% fall of the industry and a 13.8% rise of the S&P 500 composite.

The renowned global medical device company has a market capitalization of $40.6 billion. Edward Lifesciences’ earnings surpassed estimates in three of the trailing four quarters and broke even in one, delivering an average surprise of 2.03%.

Let’s delve deeper.

Upsides

Surgical Structural Heart, a Promising Business: The business benefits from the strong market adoption of Edwards Lifesciences’ premium RESILIA products across all regions. The RESILIA portfolio has been widely adopted due to the excellent durability of its proven tissue technology, supported by the recent seven-year aortic data and five-year mitral data from the COMMENCE clinical trial.

In the third quarter, patient enrollment continued for the MOMENTIS clinical study, which is designed to demonstrate the durability of the RESILIA tissue in the mitral position. Management has reaffirmed the full-year outlook of $960 million to $1.02 billion for this business, implying low-double-digit constant-currency growth.

Image Source: Zacks Investment Research

TMTT Portfolio Holds Potential: In the third quarter, sales of TMTT products increased massively by 65%, driven by the accelerated adoption of the differentiated PASCAL precision platform, the activation of more centers across the United States and Europe and key TEER (Transcatheter edge-to-edge repair) pulmonary hypertension (ph) procedural growth.

In addition, favorable clinical outcomes continue to exhibit the impressive performance of PASCAL Precision and the comprehensive high-touch model, with Edwards’ team planning to launch PASCAL Precision in Japan before the end of the year. Moreover, EW completed enrollment for the ENCIRCLE pivotal trial for SAPIEN M3 mitral valve replacement, slowly advancing toward offering an important valve replacement option beyond TEER to serve even more patients suffering from mitral valve disease.

Strong Solvency: As of the end of the third quarter of 2023, the company reported a total debt of $596.8 million, almost similar to the second quarter. Cash and cash equivalents (including short-term investments) totaled $1.86 billion, sufficient to meet the full debt obligations.

Downsides

Macro Concerns Put Pressure on the Bottom Line: Edwards Lifesciences has been grappling with escalated expenses for a while. In the third quarter of 2023, the company’s SG&A expenses rose 16.5%, driven by performance-based compensation and investments in transcatheter field-based personnel in support of EW’s growth strategy. R&D expenses in the quarter also increased, led by continued investments in transcatheter valve innovations, including increased clinical trial activity.

Competitive Risks: The company faces substantial competition and competes with many technologies and companies of all sizes based on cost-effectiveness, technological innovations, product performance, brand name recognition, breadth of product offerings, product advantages, pricing and availability and rate of reimbursement. Without the timely innovation and development of products, EW stands at the risk of its products becoming obsolete or less competitive because of the introduction of its competitor’s newer technologies or changing customer preferences.

Estimate Trend

The Zacks Consensus Estimate for Edwards Lifesciences’ 2023 earnings per share (EPS) has moved south from $2.55 to $2.51 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $5.97 billion. This suggests a 10.9% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM.

Haemonetics has an estimated earnings growth rate of 28.4% for fiscal 2024 compared with the industry’s 14.3%. HAE’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 16.1%. Its shares have decreased 2% compared with the industry’s 5.1% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Insulet, sporting a Zacks Rank #1 at present, has a long-term estimated earnings growth rate of 39.1% compared with the industry’s 20.7%. Shares of the company have decreased 36.9% compared with the industry’s 5.1% decline over the past year.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.5%.

DexCom, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 33.6% compared with the industry’s 13.8%. Shares of DXCM have fallen 1.5% compared with the industry’s 6.3% decline over the past year.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report