Here's Why You Should Retain Envestnet (ENV) Stock for Now

Envestnet ENV has strong asset-based and subscription-based recurring revenue generation capacity. The company continues to focus on technology development to improve operational efficiency and increase market competitiveness. Partnerships bolster growth opportunities for the company.

ENV has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Favorable Factors

Envestnet, through platform improvements, partnerships and acquisitions, offers a distinctive financial network that connects technology, solutions and data. It invested $28.36 million in partnerships in 2022. On May 31, 2022, the company acquired 401kplans.com LLC and successfully integrated it into the Envestnet Wealth Solutions segment. This acquisition underscores Envestnet’s dedication to the retirement plan sector. It aims to streamline the experience and boost advisor productivity by facilitating the selection of the most suitable 401(k) plans for its clients. The move has boosted the Envestnet Wealth Solutions segment.

Recently, Envestnet collaborated with iconik, a voting technology provider, to enhance proxy voting for Sustainable Quantitative Portfolios. This empowers investors to express their views effectively. Driven by the demand for choice, the partnership aids advisors in boosting retention, thus fostering long-term capital stewardship and personalizing client interactions. This helps to enhance the company’s competitive edge.

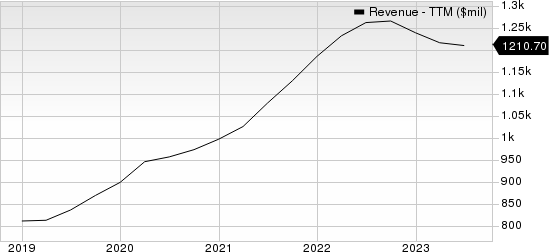

Envestnet, Inc Revenue (TTM)

Envestnet, Inc revenue-ttm | Envestnet, Inc Quote

Envestnet's strong revenue generation comes from asset and subscription-based models, which serve financial clients through a business-to-business-to-consumer approach, thus offering platform solutions to end users. Additionally, the models provide an open API framework for B2B clients and third-party developers.

Envestnet is actively emphasizing technology advancement to improve efficiency, competitiveness, regulatory compliance and client responsiveness. Its existing technology structure follows a three-tier architecture, which includes a web-based user interface, an application tier with core business logic, and a SQL Server database, providing significant scalability potential.

Risks

Envestnet's current ratio at the end of second-quarter 2023 was pegged at 0.73, lower than the previous quarter's current ratio of 0.75 and the prior-year quarter's current ratio of 0.77. Decreasing current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

ENV currently carries a Zacks Rank #3 (Hold).

The following better-ranked stocks from the Business Services sector are worth consideration:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9% The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.72 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings suggests growth of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report