Here's Why You Should Retain EverQuote (EVER) in Your Portfolio

EverQuote, Inc. EVER is well-poised to grow from reduced operating expenses, the enhancement of its platform via machine learning and artificial intelligence and expected recovery in the auto insurance business.

Earnings Surprise History

EverQuote has a decent earnings surprise history. Its bottom line beat estimates in each of the last four quarters, the average being 28%.

Zacks Rank & Price Performance

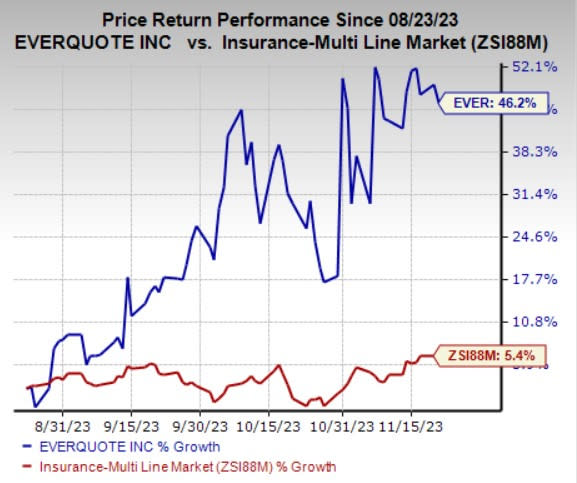

EVER currently carries a Zacks Rank #3 (Hold). In the past three months, the stock has gained 46.2% compared with the industry’s increase of 5.4%.

Image Source: Zacks Investment Research

Growth Drivers

EVER remains focused on rapidly expanding into new verticals. Growth in overall consumer quote requests should benefit EverQuote as it reflects the insurer’s success in generating consumer traffic and the potential to increase the share of insurance-shopping consumers.

Variable marketing margin (VMM) is likely to gain from declining customer acquisition costs and a shift of revenue mix to local agent networks with higher VMM. The company also decided to reduce its non-marketing operating expenses by 15%. This is expected to drive an improvement in the VMM operating point for the business. However, the troubled automotive industry could impact the VMM and could also delay its improvement until 2024. The company expects VMM to range between $16.5 and $18.5 million for the fourth quarter of 2023, the midpoint of which indicates a decline of 39.9% year over year.

EverQuote boasts a debt-free balance sheet with cash balance improving over the last three years. The insurer aims to meet any future debt service obligations with the existing cash and cash equivalents and cash flows from operations, which are expected to be sufficient to fund operating expenses and capital expenditure requirements for at least the next 12 months, without considering liquidity available from the revolving line of credit.

The company discontinued its health insurance vertical in June 2023 in a bid to reduce expenses and enhance capital efficiencies. Moreover, EVER focused its resources on home and renters’ insurance, whose revenues showed an improvement of 51% year over year in the third quarter. This move highlights its ability to generate good top-line performance from a less troubled segment.

However, EverQuote's top line has been decreasing over the past few quarters owing to the auto insurance downturn since 2021. The company expects revenues between $47 million and $52 million in the fourth quarter, implying a year-over-year decline of 26.3% from the midpoint. However, the company’s expectation of insurance premium increases and improving the profitability of insurance carriers should fuel its top-line growth in the near future due to higher demand for customer acquisition. Moreover, the cost of claims shows signs of stabilization, improving the prospects for EVER and the auto insurance industry.

EVER also has an impressive Growth Score of B. This style score helps analyze the growth prospects of a company.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Goosehead Insurance, Inc. GSHD, Old Republic International Corporation ORI and Assurant, Inc. AIZ. While Goosehead Insurance sports a Zacks Rank #1 (Strong Buy), Old Republic International and Assurant carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Goosehead Insurance’s earnings surpassed estimates in three of the last four quarters, the average earnings surprise being 100.4%.

The Zacks Consensus Estimate for GSHD’s 2023 and 2024 earnings has moved 3.4% and 1.9% north, respectively, in the past 30 days. In the past year, the insurer has gained 81.3%.

Old Republic International’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 28.6%.

The Zacks Consensus Estimate for ORI’s 2023 and 2024 earnings has moved 6.2% and 3% north, respectively, in the past 30 days. In the past year, the insurer has gained 18.7%.

Assurant’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 42.4%.

The Zacks Consensus Estimate for AIZ’s 2023 and 2024 earnings implies 27.5% and 5.7% year-over-year growth, respectively. In the past year, the insurer has gained 29.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Goosehead Insurance (GSHD) : Free Stock Analysis Report