Here's Why You Should Retain Exact Sciences (EXAS) Stock Now

Exact Sciences Corporation EXAS is likely to register growth in the coming quarters, led by the broad-based momentum in Cologuard adoption. The company is progressing well with its strategic prioritization, which is likely to drive the company’s future growth. The raised 2023 guidance is an indication of consistent growth.

Heavy dependence on the Cologuard test and operating in a highly-competitive space are a concern for the company.

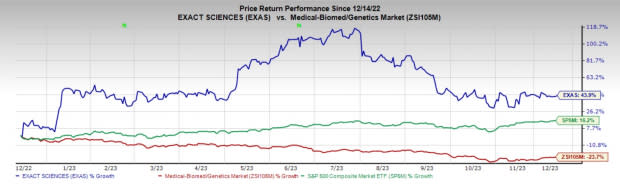

In the past year, this Zacks Rank #3 (Hold) stock has surged 43.9% against a 23.7% decline of the industry and a 16.2% rise of the S&P 500 composite.

The renowned global medical device company has a market capitalization of $11.65 billion. The company has an expected earnings growth rate of 41.1% for the next year compared with the industry’s 11.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 25.12%.

Let’s delve deeper.

Key Drivers

Strong Cologuard Adoption: The company is focusing on three areas to enhance Cologuard growth. Building the best and most effective commercial organization in healthcare by investing in the leadership team, training and sales force effectiveness is the first strategy. Secondly, improving the customer experience by making it simpler to order Cologuard electronically and continue rescreening patients every three years; and third, screening more people starting at age 45 to catch cancer earlier. In terms of the latest development, more than 9,000 new healthcare professionals ordered Cologuard during the second quarter and more than 321,000 have ordered since launch. About 75% of all US primary care physicians have ordered Cologuard.

Advancing New Solutions: With regard to the third priority of advancing new solutions, Exact Sciences is planning several key milestones to bring six innovative cancer diagnostics from its pipeline to patients in need.

In August 2023, Exact Sciences presented new data confirming Exact Sciences' approach to multi-cancer early detection (MCED), real-world outcomes using the Oncotype DX Breast Recurrence Score and modeling comparisons between Cologuard and potential blood-based screening tests for colorectal cancer.

Image Source: Zacks Investment Research

In June 2023, Exact Sciences entered into a separate collaboration with two renowned healthcare organizations at the forefront of cancer research. The agreements aim to improve patient care by increasing access to genomic information.

Raised 2023 Guidance: The company raised its 2023 revenue guidance to $2.476-$2.486 billion (from the earlier range of $2.441-$2.466 billion). The Zacks Consensus Estimate for the same is pegged at $2.26 billion.

For 2023, the company expects its Screening revenues to be in the range of $1.820-$1.835 billion. The company expects Precision Oncology revenues in the range of $615-$625 million.

Downsides

Reliance on Cologuard Test: Exact Sciences’ financial results continue to be highly vulnerable to the performance of its leading Cologuard test. Per management, its ability to generate revenues will depend very substantially on the commercial success of its Cologuard and Oncotype DX breast cancer tests for at least the next 12 months. In case the company is unable to continue to boost sales of Cologuard and Oncotype DX breast cancer tests or if it is delayed or limited in doing so, EXAS’ business prospects, financial condition and results of operations will be affected.

A Tough Competitive Landscape: Given the large market for colorectal cancer screening, Exact Science faces numerous competitors, some of which possess significantly greater financial and other resources and development capabilities than the company.

Estimate Trend

In the past 30 days, the Zacks Consensus Estimate for Exact Sciences’ loss for 2023 has dropped from $1.90 per share to $1.48.

The Zacks Consensus Estimate for 2023 revenues is pegged at $2.48 billion, suggesting a 19.1% rise from the 2022 reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2 (Buy), Insulet presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. The company's shares have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report