Here's Why You Should Retain FLEETCOR (FLT) in Your Portfolio

For FLEETCOR Technologies FLT, acquisitions serve as means to broaden its customer base, increase its workforce and operational capacity, and expand its service portfolio across various industries. The company's ongoing commitment to share repurchases not only enhances investor confidence but also has a favorable effect on its earnings per share.

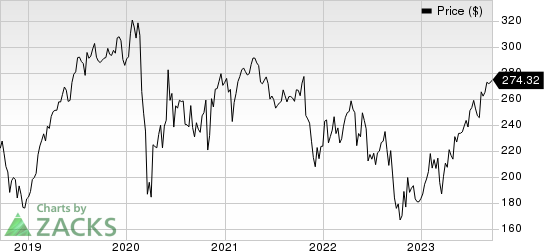

The company's shares have gained 49.3% in the year-to-date period, outperforming its industry’s 15.1% growth.

FleetCor Technologies, Inc. Price

FleetCor Technologies, Inc. price | FleetCor Technologies, Inc. Quote

Factors That Augur Well

FLEETCOR's acquisitions have been making a substantial impact on its revenue growth. The company has been consistently pursuing acquisitions and investments, both domestically in the United States and on a global scale, with the goal of increasing its customer base, workforce, operational capabilities, and expanding the range of services it offers across various industries. The company has recently acquired three key entities: Global Reach Group, a UK-based global cross-border provider; Mina Digital Limited, a cloud-based electric vehicle charging software platform; and Business Gateway AG, a technology provider for service, maintenance, and repair. These acquisitions mark a significant expansion of the company's product portfolio and geographic presence.

FLEETCOR's top-line growth remains robust due to organic factors such as increased transaction volumes and higher revenues per transaction in specific payment programs. The company consistently experiences strong organic revenue growth, primarily attributed to the success of its product categories, which encompass fuel, corporate payments, tolls, and lodging. Notably, the organic revenue growth rates were 13% in 2022, 12% in 2021, 11% in 2019, 10% in 2018, and 9% in 2017.

FLEETCOR Technologies' commitment to rewarding its shareholders through share repurchases is praiseworthy. In 2022, the company repurchased shares worth $1.41 billion, and in 2021, it repurchased shares amounting to $1.36 billion. These actions underscore the company's dedication to creating value for shareholders and demonstrate its confidence in its business. Such shareholder-friendly initiatives not only enhance investor confidence but also have a positive impact on earnings per share.

Key Risk

FLEETCOR's extensive global footprint exposes it to the risks associated with fluctuations in foreign currency exchange rates. Beyond the United States, the company conducts transactions in various currencies, including the British pound, Brazilian real, Canadian dollar, Russian ruble, Mexican peso, Czech koruna, Euro, Australian dollar, and New Zealand dollar. It is worth noting that unfavorable foreign exchange rate movements had an adverse impact on the company's revenues, amounting to $47 million in 2022, $112 million in 2020, $61 million in 2019, and $49 million in 2018.

Zacks Rank and Stocks to Consider

FLT currently carries a Zacks Rank #3 (Hold). Here are some better-ranked stocks from the broader Business Service sector, which you may consider:

Verisk Analytics VRSK has beaten the Zacks Consensus Estimate in three of the four previous quarters and matched on one instance, with an average surprise of 9.9% The consensus mark for 2023 revenues is pegged at $2.66 billion, which reflects a decrease of 8.2% from the year-ago figure. Earnings are pegged at $5.71 per share for 2023, which is 14% above the year-ago figure. VRSK currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP presently has a Zacks Rank of 2. The company beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It beat the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings calls for a rise of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report