Here's Why You Should Retain Glaukos (GKOS) in Your Portfolio

Glaukos Corporation GKOS is well poised for growth, backed by favorable clinical trial results and a robust product pipeline. However, stiff competition is a concern.

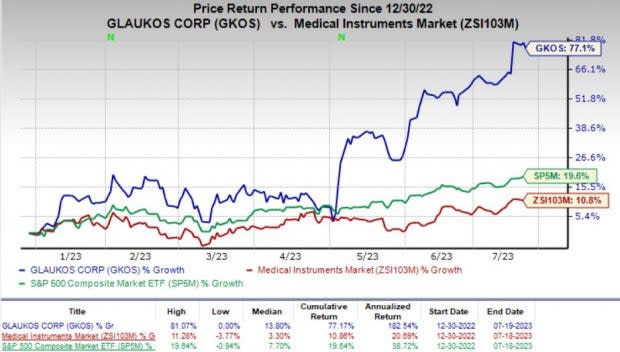

Shares of this Zacks Rank #3 (Hold) company have rallied 77.1% year to date compared with the industry’s 10.8% growth. The S&P 500 Index also increased 19.6% in the same time frame.

Glaukos, with a market capitalization of $3.8 billion, is a leading ophthalmic medical technology and pharmaceutical company. It projects earnings growth of 17.5% for 2024 and expects to maintain strong performance in revenues over the next two years.

Image Source: Zacks Investment Research

The company has an average negative four-quarter earnings surprise of 16.23%.

Key Catalysts

Clinical trials are the primary means to evaluate the efficacy and safety of new medical technologies.

In May, the FDA accepted the previously submitted New Drug Application for one of Glaukos’ advanced pipeline candidates, iDose TR. A potential approval for the candidate, expected by 2023-end, will substantially boost the company’s revenues.

Per top-line data from two pivotal studies, GKOS announced that its targeted injectable implant candidate, iDose TR, for glaucoma patientsachieved excellent tolerability and a favorable safety profile last year. The candidate achieved non-inferior reductions in intraocular pressure (IOP) in three months from its baseline compared with the timolol ophthalmic solution.

Glaukos launched iPrime — a new disco elastic delivery device — in the latter part of the second quarter of 2022. In the first quarter, the company had launched the iAccess device for go anatomy procedures.

The addition of these new devices will provide unique treatment options for surgeons, customers and patients. The iAccess device has gained positive market feedback.

In August 2022, Glaukos received clearance from the FDA for the commercialization of iStent infinite — an implantable device intended to reduce the IOP of the eye in adult patients with primary open-angle glaucoma in whom previous medical and surgical treatments failed.

The company has already launched the product. During the first quarter, iStent infinite helped GKOS’ U.S. glaucoma franchise to return to growth.

GKOS is also developing three other candidates, GLK-301, GLK-302 and third-generation iLink therapy, as potential treatments for Dry Eye Disease, presbyopia and keratoconus, respectively, in separate phase II studies.

These positive developments make us optimistic about the stock. Its better-than-expected first-quarter earnings and revenues are also encouraging.

What’s Hurting GKOS?

Glaukos’ competitors include medical companies, academic and research institutions, as well as others that develop new drugs, therapies, medical devices or surgical procedures to treat glaucoma. Thus, intense competition continues to weigh on the company’s overall performance.

Estimate Trend

The bottom-line estimate for GKOS is pegged at a loss of $2.27 per share for 2023, 4.1% wider than the previous year’s reported loss of $2.18. The Zacks Consensus Estimate for revenues is pinned at $297.6 million, indicating growth of 5.2% from the year-ago figure.

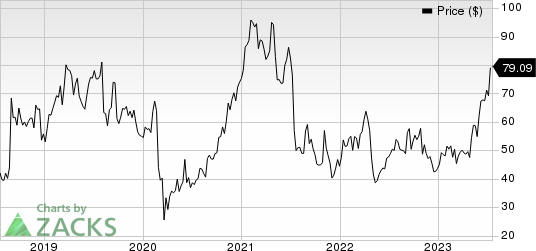

Glaukos Corporation Price

Glaukos Corporation price | Glaukos Corporation Quote

Stocks to Consider

Some better-ranked stocks from the broader medical space are Alcon ALC, Perrigo Company PRGO and Hologic HOLX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Alcon has an estimated long-term growth rate of 14.9%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 8.85%.

ALC’s shares have rallied 23.8% year to date compared with the industry’s 10.8% growth.

Perrigo’s earnings are expected to improve 24.6% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, delivering an average negative surprise of 0.79%.

The company’s shares have risen 0.4% year to date compared with the industry’s 4.5% growth.

Hologic has an estimated earnings growth rate of 4.1% for fiscal 2024. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 27.32%.

HOLX’s shares have risen 5% year to date compared with the industry’s 10.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report