Here's Why You Should Retain Glaukos (GKOS) Stock for Now

Glaukos Corporation GKOS is well-poised for growth, backed by favorable clinical trial results and a robust product pipeline. However, stiff competition is a concern.

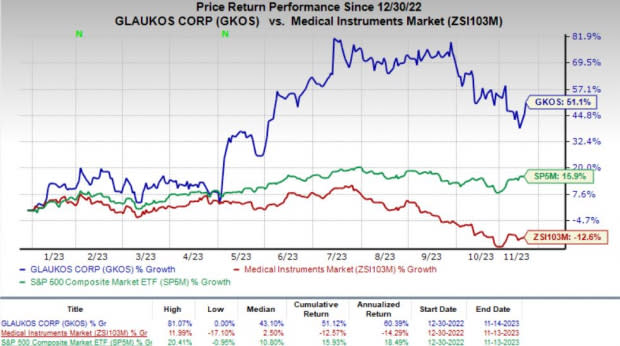

Shares of this Zacks Rank #3 (Hold) company have rallied 51.1% year to date against the industry’s 12.6% decline. The S&P 500 Index also increased 15.9% in the same time frame.

Glaukos, with a market capitalization of $3.47 billion, is a leading ophthalmic medical technology and pharmaceutical company. It projects earnings growth of 9.5% for 2024 and also expects to maintain its strong performance in terms of revenues.

Image Source: Zacks Investment Research

The company has an average four-quarter earnings surprise of 5.72%.

Key Catalysts

Glaukos’ sales returned to growth following a declining trend in 2022, reflecting an improving macro environment coupled with the launch of several new products in the past few quarters. Continued strong demand across international Glaucoma and Corneal Health franchises will be the key top-line drivers in the rest of 2023.

Moreover, the commercial launch of iStent infinite in 2023 is boosting the U.S. glaucoma franchise, which will drive growth in the upcoming few quarters. The company’s raised outlook for revenues on its second-quarter earnings call looks promising.

Meanwhile, the new local coverage determinations proposed in June 2023 are likely to remove certain ophthalmic goniotomy and canaloplasty procedures from coverage. This will likely have a positive impact on the iStent business.

GKOS has launched several products, including iPrime, iAccess and iStent, in the past few quarters, which are aiding its revenue growth. The company has been focused on delivering improved outcomes for patients suffering from chronic eye diseases. It does so by continuing to develop a pipeline of novel, dropless platform technologies designed to meaningfully advance the standard of care.

One of the advanced pipeline candidates, iDose TR, has been successfully tested in a phase III study. Glaukos filed a new drug application with the FDA in February and a decision regarding the same is expected later this year. The company stated that the targeted population is 3 million in the United States every year. A potential approval for the candidate will substantially boost Glaukos’ revenues.

Per top-line data from two pivotal studies, GKOS announced that its targeted injectable implant candidate, iDose TR, for glaucoma patients achieved excellent tolerability and a favorable safety profile last year. The candidate achieved non-inferior reductions in intraocular pressure in three months from its baseline compared with the timolol ophthalmic solution.

What’s Hurting GKOS?

Glaukos’ competitors include medical companies, academic and research institutions, as well as others that develop new drugs, therapies, medical devices or surgical procedures to treat glaucoma. Thus, intense competition continues to weigh on the company’s overall performance.

Moreover, the U.S. Centers for Medicare & Medicaid Services significantly reduced physician payment rates in 2022, which led to lower U.S. Glaucoma sales volume in the year. With no significant change in payment rates in 2023, the impact continued through the year and will continue to adversely impact sales in the last quarter of the year.

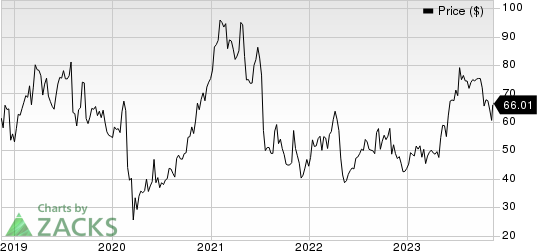

Glaukos Corporation Price

Glaukos Corporation price | Glaukos Corporation Quote

Estimate Trend

The bottom-line estimate for GKOS is pegged at a loss of $2.22 per share for 2023, 1.8% wider than the previous year’s reported loss of $2.18. The Zacks Consensus Estimate for revenues is pinned at $308.4 million, indicating growth of 9% from that recorded in the prior year.

Stocks to Consider

Some better-ranked stocks from the same medical industry are Cardinal Health CAH, Biodesix BDSX and Patterson Companies PDCO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health has an estimated long-term growth rate of 15.2%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 15.67%.

CAH’s shares have rallied 35.4% year to date.

Biodesix has an estimated growth rate of 22.7% for 2024. Its earnings surpassed estimates in three of the trailing four quarters and met the same once, delivering an average surprise of 9.76%.

BDSX’s shares have lost 44.8% year to date.

Patterson Companies has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and met the same once, delivering an average surprise of 8.47%.

PDCO’s shares have risen 8.8% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report