Here's Why You Should Retain Hologic (HOLX) Stock for Now

Hologic, Inc. HOLX is well-poised for growth in the coming quarters, backed by the witness revenue growth with recovery in procedural volumes and acceleration from new business lines. The company’s Breast Health segment continues to deliver strong growth, driven by higher capital equipment revenues.

The significant decline in COVID-19 assay revenues continues to dent the top line. Foreign exchange woes and macroeconomic challenges impede the company’s growth.

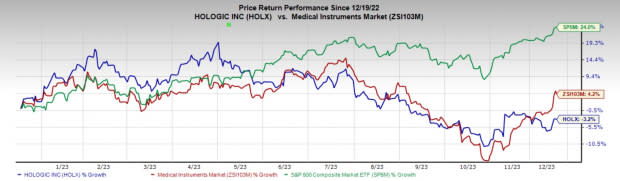

In the past year, this Zacks Rank #3 (Hold) stock has declined 3.2% against 4.2% growth of the industry and a 24% rise of the S&P 500.

The renowned medical device company has a market capitalization of $17.05 billion. Hologic surpassed earnings estimates in all the trailing four quarters, delivering an average surprise of 12.43%.

Let’s delve deeper.

Factors at Play

Strength in Breast Health: Hologic’s has been making impressive progress in the Breast Health arm recently, leveraging its strategic expansion efforts to diversify business across the patient continuum of care.

In the fourth quarter of fiscal 2023, the Breast Health arm registered strong growth primarily driven by the recovery in the gantry business. Interventional Breast grew in the low double digits. Increased Trident systems unit sales and higher Faxitron breast-conserving surgery products supported the upside. The increase in volume was driven by the improvement in supply chain constraints related to electronic components, primarily semiconductor chips.

Focus on International Operations: The company’s international sales have been a major catalyst in the past few years, with the major driver being the molecular diagnostics business. Hologic is focusing on commercial infrastructure. The company has been progressing impressively with respect to the placement of Panther instruments across the globe.

Image Source: Zacks Investment Research

Hologic strengthened its international businesses significantly over time. The company’s Breast Health business is getting stronger. Diagnostics benefited from all the additional Panther placements and is growing tremendously internationally. The Surgical arm also continues to shine. In 2023, the international Surgical growth rate was more than double the U.S. growth rate.

GYN Surgical’s Strength: GYN Surgical’s growth continues to be driven by strong contributions from a hysteroscopic portfolio of MyoSure, the Fluent fluid management system and NovaSure. The company is encouraged by the strong performance of its latest NovaSure iteration, the NovaSure V5. The laparoscopic portfolio continues to build momentum and is growing into a larger driver for the division. Through Acessa and Bolder acquisitions, the company integrated Acessa’s procedure and Bolder’s advanced vessel sealing portfolio into its product line.

Downsides

Lower COVID Sales Hamper Growth: During the COVID-19 public health emergency, Hologic launched several assays to detect COVID. However, the company is experiencing a persistent decline in COVID testing-related demand and is expected to continue at much lower levels in 2023 as customer testing and therapy and vaccine demand declines.

In the fourth quarter of fiscal 2023, COVID-19 revenues, which consist of COVID-19 assay revenue and other COVID-19 related revenues and revenues from discontinued products, plunged 75.6% on reported and constant currency.

Macroeconomic Concerns: Continued concerns about the systemic impact of potential long-term and widespread recession and geopolitical issues, including the war in Ukraine, have contributed to increased market volatility and diminished expectations for economic growth in the world. Hologic business and results of operations have been and may continue to be adversely impacted by changes in macroeconomic conditions, including inflation, rising interest rates and availability of capital markets.

Estimate Trends

In the past 90 days, the Zacks Consensus Estimate for Hologic’s fiscal 2024 earnings has remained constant at $3.99 per share.

The Zacks Consensus Estimate for HOLX’s fiscal 2023 revenues is pegged at $3.98 billion, suggesting a 1.4% fall from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2 (Buy), Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. The company's shares have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report